Twino and COVID-19

Twino Review: Despite the COVID-19 pandemic, Twino’s performance has remained stable. More than 75% of my loans are still performing on-time and those that are delayed for more than 60 days are being covered by the BuyBack/PayBack. Sold loans on Twino increased by 13% over the course of June.

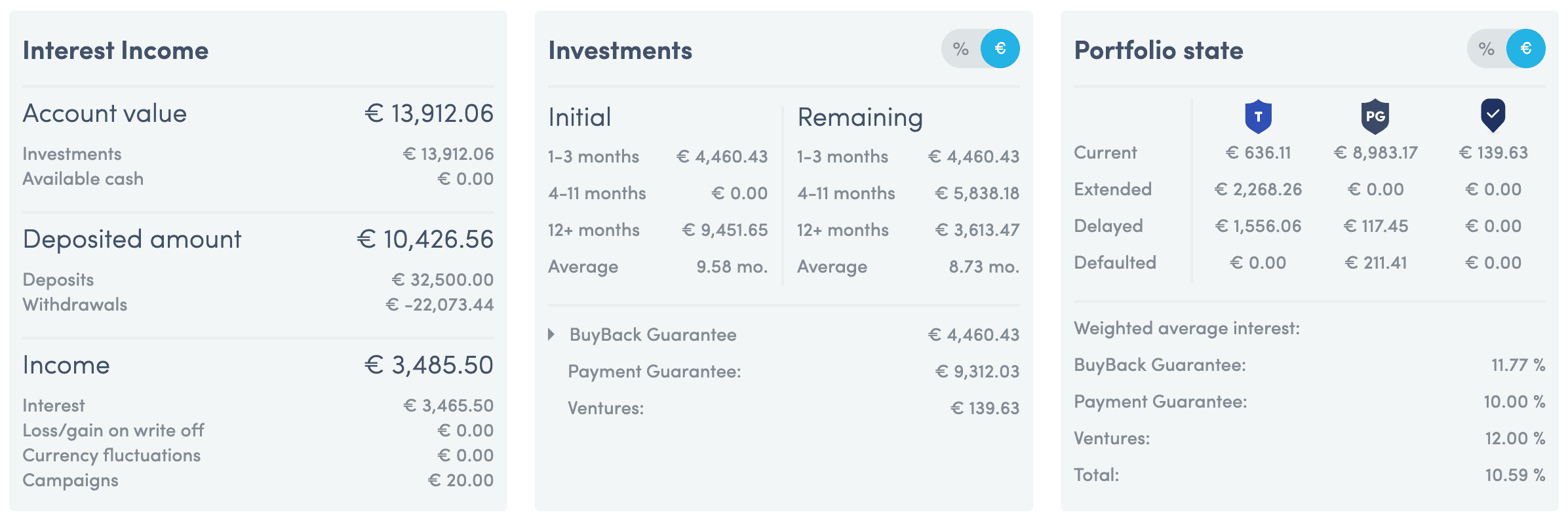

Here is my honest Twino review and experience investing on the Twino Peer-2-Peer (P2P) lending platform since June 2015. Over the past five years, I have received an average annual return of 10.52 % per year for my invested 13,500 EUR. All loans have BuyBack guarantee and investmens are automated (auto-invest feature).

To me, Twino (SIA Twino) has proven to be a reliable platform and I am planning to continue increasing my investments on the platform in 2020. I started with Twino in June 2015 to further diversify my passive income investment portfolio and things have turned our very well. There was a period in 2019 when I had temporarily withdrawn most of my money from the platform after Twino had released their 2017 report, but it turned out everything was fine and the platform is in good financial shape. I went back with 13,500 EUR which are full invested.

I have earned more than 3,400 EUR in interest since I joined Twino in 2015.

This Twino 2020 Review is 100% honest and truthful. I am not paid by Twini or anyone else for sharing my experience. My intention with this review is to document my journey and to inspire others to build passive income through P2P, Real Estate Crowdfunding and ETF investments that run in the background without much work. At the end of this review, I am sharing my Twino auto-invest settings.

Twino Review Quick Facts

✅ Loans available at 10-12% interest

✅ All loans have BuyBack guarantee

✅ Most loans are short-term consumer loans from Latvia, Polan, Russia, and Kazakhstan

✅ Secondary market allows selling of loans at any time

✅ Twino recently started with Twino Venture, allowing to invest in real estate ventures

🔴 Loan originator diversification within platform not possible as Twino is the only loan originator

🔰 Twino HQ: Riga, Lativa

🔰 Founded in 2009. Since then, more than 1 billion EUR in loans successfully funded through platform

About Twino

Twino specializes in short-term unsectured consumer loans. All loans yield 12-14% interest annually and have BuyBack or PayBack guarantee from Twino. Twino started its operations in 2009 and SIA Twino in 2015. The Twino group has since grown to more than 400 employees.

Twino provides “us” European investors an opportunity to invest in consumer loans issued by TWINO Group subsidiaries in Poland, Russia, Latvia, Kazakhstan, Vietnam and elsewhere.

All loans are on Twino are either covered by a BuyBack guarantee or by a PayBack guarantee. For loans with BuyBack guarantee, TWINO will buy back loans (principal amount and interest for investment period) from investor if the loan is 60 or more days delayed. For loans with PayBack guarantee, TWINO will compensate both the invested principal amount and interest according to the loan repayment schedule for the whole loan period, even if the borrower is late with the repayment. That means that for me as an investor, there is no risk of losing money from lenders that fail to repay their loans.

With more than 21,000 active investors who have invested more than 1 billion EUR through Twino since 2015, for me, Twino provides a great platform to diversify my P2P lending portfolio (together with Mintos and Swaper) given their different lending countries.

My Twino review and experience

I started with 5,000 EUR in 2015 and have increased my investment to 13,500 EUR on the Twino platform. My monthly interest income is between 90 and 120 EUR (every month!) which is 8-10% p.a. After my initial adjusting of the auto-invest portfolio, everything is on auto-pilot and requires no work or maintenance. The platform works like a charm and I am a happy investor.

Getting started with Twino: Opening a free investors account

Opening an account and getting started investing with Twino is really easy:

- Register for a free investor account: Equipped with a passport or Government ID, the signing up and verification process takes about two minutes. The platform requires you to upload photos of both sides of your passport or Government ID. I took a photo with my smartphone which worked great.They do not verify your identity by webcam, Here is the link: LINK

- Add funds: I added funds to my newly opened account through a regular SEPA bank transfer (which is free of charge) from my regular bank account. The funds showed up less than 2 days after I had made the transfer, which was fantastic!

- Set auto-invest feature/portfolio: While it would be possible to invest manually, I prefer using their auto-invest feature, which means that I don’t have to do anything by hand and I get new loans automatically when they become available. Here are my auto-invest settings

- Thats it! Following these three steps, I can lean back and start receiving monthly interest payments ! 🥳

My Twino Dashboard

The Twino dashboard is very simple and easy to use. It is well organized and allows users to get an overview at one glance. It reminds me of Mintos.

The Twino Dashboard shows all important information, including:

- Account Value

- Deposited Amount

- Interest Income

- Current Investments (here you see how many months your loans have left before they can be reinvested)

- Portfolio State (here you see how many of your loans are performing on time vs are delayed)

- Weighted average interest/ Return

My Twino auto-invest portfolio

Twino has an auto-invest functionality which makes investing super easy and fully automated. Once set up, the auto-invest does all the work and does not require any “manual” investing. I receive an overview email every Monday morning which informs me about earned interest and account balance. It’s always a nice way to start a week to get an email telling you how much passive income you have earned 🙂

Here’s a list of settings that can be adjusted in the auto-invest portfolio:

- Your investment: The total size of the auto-invest portfolio. I usually set this a little bit higher than what I am investing as the portfolio will grow through interest. For example, I have mine set to 16,000 EUR

- Per loan: The maximum amount that you are willing to invest in one loan. I set this setting to 135 EUR to make sure that I am investing in at least 100 different loans and am thus better diversified in case some of the loans are paid back with a delay.

- interest rate (%): This is the monthly interest that you are will to invest in. I set mine to 9-15%.

- Countries: The countries you are willing to invest in. I set mine to all countries.

- Loan types: The kinds of loans that you are willing to investing in. I selected all of them.

- Loan rating: I selected all three (BuyBack, PG=PaymentGuarantee, and Ventures). Ventures are real estate ventures.

- Loan status: I only select Current here. Somehow my instinct tells me that if a loan is already extended or delayed, the chances that it will get further delayed are pretty high.

- Include loans with Currency Exposure: In order to avoid currency exchange rate fluctuations, I decided to not invest in loans with Currency Exposure.

- Make this investment a Reinvestment: Yes, I do want to automatically reinvest once the first loans have been paid back.

Below is a screenshot of my auto-invest portfolio. As one auto-invest porfolio goes only up to 10,000 EUR, I have two seperate auto-invest portfolios with identical settings.

Twino’s main competitors

Peer-to-Peer lending: Mintos, Swaper

Real estate crowdfunding: CrowdEstate, EstateGuru

Twino experience & review: Conclusion

For me, Twino is an interesting and reliable platform to diversify my passive income investment portfolio. With interest rates around 10%, the returns are not as high as other platforms (for example at Swaper), but the platform is reliable, trustworthy, and has a great track record.

The Twino Group, which includes SIA TWINO, reported pre-tax profits of 13 mio EUR for 2018. This is a great result, especially when compared to its 7.2 mio EUR loss the year previous. Twino releases fiancial statements both consolidated for the entire group as well as for SIA TWINO, the P2P lending arm.

It is great to see that Twino is committed to increasing transparency and regulation of the European P2P Lending Market. Earlies this year, Twino applied for an investment brokerage licence from the Latvian Financial and Capital Market Commission (FCMC). As part of the license, investors will be eligible for the FCMC investor protection mechanism of up to 20,000 EUR.

As the platform is growing, it is great to see that Twino continues to receive quite a lot of recognition as an innovative FinTech company. Earlier this month (July 2020), Twino received the awarded “Best Crowdlending Platform 2020 from BankingCheck.

As of today, I have 13,500 EUR invested on Twino (monthly interest returns of 90 – 120 EUR) and I am planning to add more later this year. My goal is to diversify my investments across 3-4 P2P lending platforms to have sufficient diversification. More platforms would make it a hassle to manage my passive income.

I hope my 2020 Twino review is helpful. If you have any questions, comment below or send me a message.

Sources: