My Real Estate Crowdfunding Portfolio

My Real Estate Crowdfunding Portfolio (Real Estate P2P Lending Portfolio) includes EstateGuru and CrowdEstate in which I have invested a total amount of 12.000 EUR. I started investing in Real Estate Crowdfunding in early 2019 to further diversify my investment portfolio with secured and property-backed investments.

Real estate crowdfunding is a great way to diversify an investment portfolio as investments are property-backed with a mortgage or other guarantees, as well as because the real estate market is to a large extent independent from the stock market.

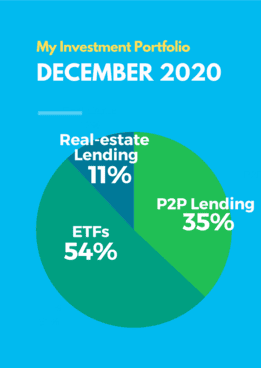

Looking at my total Investment Portfolio, Real Estate Crowdfunding represents 3% which is a small share. I am planning to expand the share to 15% within the next 12 months.

My Real Estate Crowdfunding Portfolio includes the following platforms:

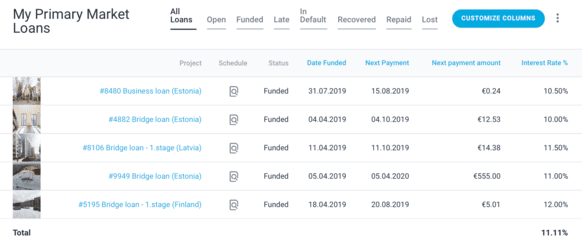

- EstateGuru: A conservative platform offering great loan securities and conservative investment opportunities (averaging 11% interest). [2020 Review]

- CrowdEstate: A platform that is known for its high returns (average historical return of 20.54%) and relatively higher risk. [2020 Review]

| Platform | Link | Currently Invested | BuyBack Guarantee | Secondary Market | Interest (XIRR) | Invested since |

|---|---|---|---|---|---|---|

| Crowdestate Review | € 950.00 | No | Yes | 12.57% | Mar'2019 | |

| Estateguru Review | € 11,000.00 | No | Yes | 11.11% | Mar'2019 |

What is Real Estate Crowdfunding (Real Estate P2P Lending):

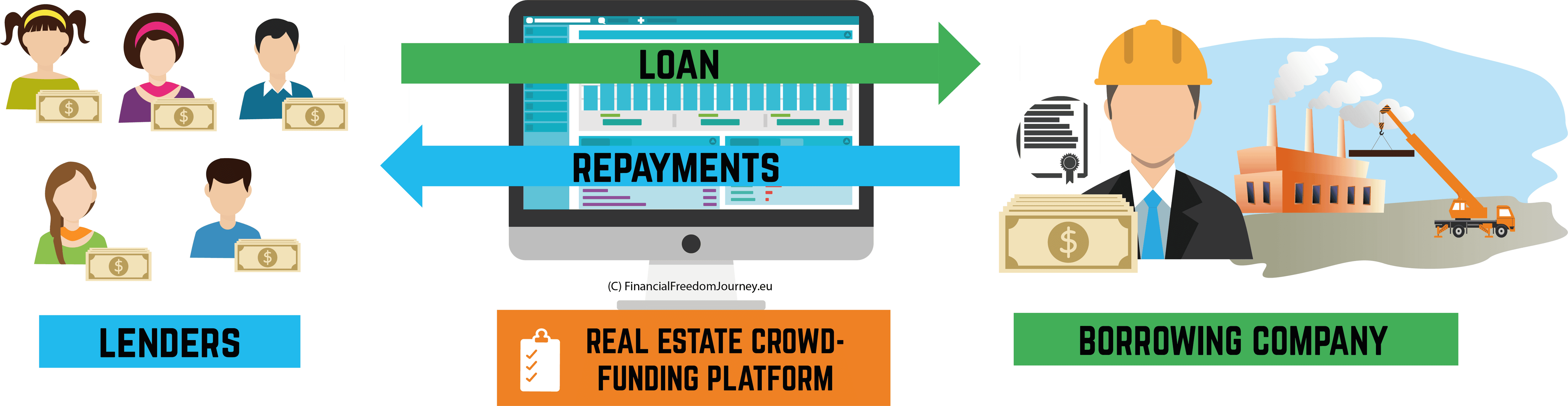

Real Estate crowdfunding is the pooling of money from a large group of investors for a real estate investment. While the pooling of money for real estate has existed for centuries, the difference between collective real estate investing and crowdfunding for real estate is that technology enables a much larger group of investors to chip in small amounts and to make all legal and financial transactions online.

Due to modern technology, today, investors can browse investments online, securely sign legal documents online, transfer funds and have access to investor dashboards to watch how investments are performing. Rather than doing diligence on hundreds of real estate transactions to find one to invest in, investors can browse lists of pre-curated investments through crowdfunding companies. (Source)

Real estate crowdfunding as an alternative to traditional means of financing real estate

As a result, real estate crowdfunding has become an interesting alternative to traditional means of financing real estate. It creates direct connections between a large number of investors and real estate developers and thus opens an asset class – which was traditionally only accessible to institutional investors and high net worth individuals – to private investors who can invest as little as 50 EUR.

Platforms and marketplaces, such as CrowdEstate and EstateGuru, are responsible for due diligence and offer pre-vetted real estate investments opportunities. The majority of loans are either secured with a first-rank mortgage (physical security), personal guarantees or are backed with a mortgage.

Is Real Estate Crowdfunding risky?

That is a fair question to ask. Real Estate Crowdfunding is a relatively new form of investment. Such as every form of investment, real estate lending bears certain risks as well. This being said, all platforms that I am investing in are offering pre-vetted real estate investments that are either secured with a first-rank mortgage (physical security), personal guarantees or are backed with a mortgage.

The platforms that I am using are not offering BuyBack guarantee, but considering the securities and the excellent track record of both CrowdEstate and EstateGuru, I feel that my money is in good hands.

Ways to reduce risks when investing in Real Estate Crowdfunding

1. Split money among platforms

As in other investment classes, this is the most important aspect and best way to reduce risk. I do not put all eggs in one basket. I use multiple platforms to diversify and to reduce risk. If one platform underperforms or runs into some issues, not all money is gone. Personally, I find for myself that investing in 2 to 3 Real Estate Crowdfunding platforms works best for me as it keeps the ‘oversight’ manageable. When investing in too many platforms, it’s easy to lose track and make mistakes.

2. Split money among different investments.

This is the second most important point. Most Real Estate lending platforms offer multiple investment opportunities. By dividing up my money into as many projects as possible, I diversify risk. If one of the investments delays payments or something goes wrong, it only marginally affects my overall portfolio.

3. Choose your investment opportunities wisely

When setting up your auto-invest portfolio it is important to pay attention. An important parameter to adjust is the loan-to-value (LTV) ratio, which tells you how much the investor is borrowing against his collateral. A higher LTV ratio suggests more risk because the assets behind the loan are less likely to pay off the loan as the LTV ratio increases. I am investing in loans up to LTV of 65%. Another parameter to pay attention to is what is referred to as stage loans, which I am not investing in. A stage loan is a separate loan from the same borrower at a different stage of the project. Considering that it is from the same borrower, certain risks compound and thus remain.

4. Don’t become greedy

It is very easy to become greedy when investing in Real Estate Development loans. Very often loans with interest rates above 12-13% are only a click away and its easy to fall for them. Don’t become greedy. Remember yourself that even interest rates of 10, 11, or 12 percent are already beyond what you could dream of.

Thanks for reading! Before heading out, would you be interested in reading my experience investing in EstateGuru or CrowdEstate?

| Platform | Link | Currently Invested | BuyBack Guarantee | Secondary Market | Interest (XIRR) | Invested since |

|---|---|---|---|---|---|---|

| Crowdestate Review | € 950.00 | No | Yes | 12.57% | Mar'2019 | |

| Estateguru Review | € 11,000.00 | No | Yes | 11.11% | Mar'2019 |