Welcome to my January 2020 Passive Income Update.

December was an incredible month of rest and recuperation. After the busy and hectic fall (October + November), I managed to really slow down in December. I worked less and spend time with my partner and her family in different parts of the US. 🥳

Some of the things we did in December included:

- An RV/Campervan trip through US national parks: A long dream of ours came finally true. We rented/relocated an RV for a week explored the national parks and national forestes in California, Nevada and Arizona. I loved it! 🚐

- Visited friends in El Paso/Texas: We visited friends of ours in El Paso for a few days and crossed by foot into Mexico/Ciudad Juárez. Super fun! 🚐

- Spend the christmas holidays in sunny Arizona. Weather and landscape-wise, one of my favorite states in the United States. ☀️

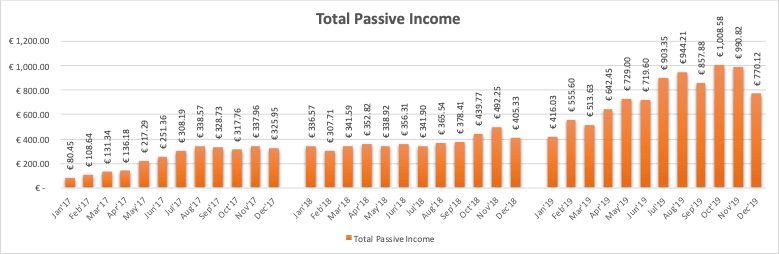

My passive income in December totalled 770,12 EUR (~860.15 USD) which is less than in previous months and was caused by cash-drag and lower interest rates. More below.

Having been paid for a few pending work contracts, I added 9,000 EUR to my P2P Lending Portfolio. I also moved 5,000 EUR from Swaper to Twino to escape the cash-drag at Swaper. Also, I am planning to invest more in the MSCI World ETF to better balance my portfolio and desired invest ratio of 60%/40%, and I am currently waiting for the a good moment to buy the ETFs at a lower price. More below.

Now, on to my passive income numbers for this past month!

January 2020 Passive Income Update

My total passive income in December 2019:

– P2P lending: 553.40 EUR

– Real Estate Lending: 13.69 EUR

– ETF Dividends: 96.15 EUR

– Stock Photos/Videos: 106.88 EUR

TOTAL: 770,12 EUR (~860.15 USD)

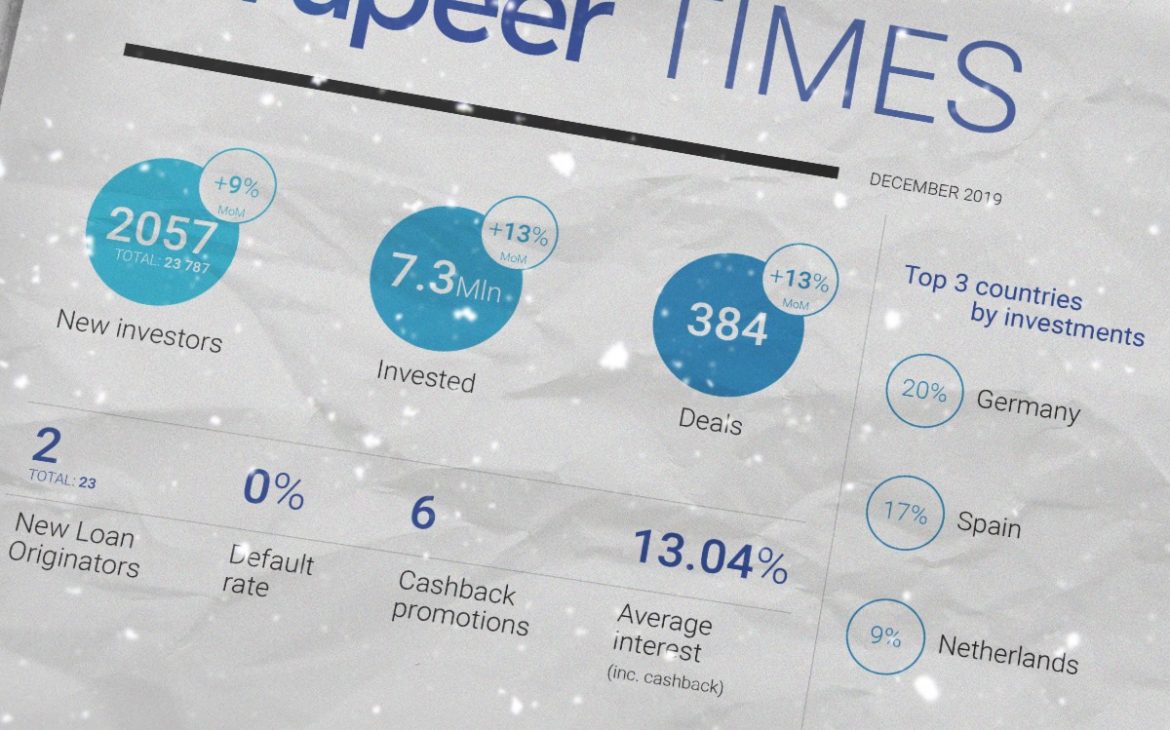

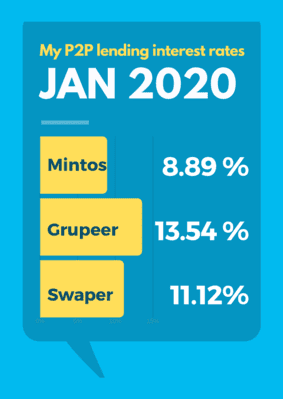

P2P Lending & Real Estate Lending Update – January 2020

| P2P Lending Platform | Dec'19 Interest Income | Dec'19 XIRR | Total Investment |

|---|---|---|---|

| Mintos | € 259.89 | 8.89% | € 32,000.00 |

| Swaper | € 145.87 | 11.12% | € 9,000.00 |

| Grupeer | € 147.64 | 13.54% | € 15,000.00 |

| Estateguru | € 13.69 | 7.77% | € 5,000.00 |

| Crowdestate | € 0 | 0.0% | € 2,000.00 |

P2P & Real Estate Lending Overview – January 2020 Passive Income Update

As part of my January 2020 passive income update, here is a quick overview of passive income that I am earning from three (3) P2P Lending and two (2) Real-Estate P2P Lending platforms that I am investing in.

Exchange– Traded Funds (ETF) Update – January 2020 🥳

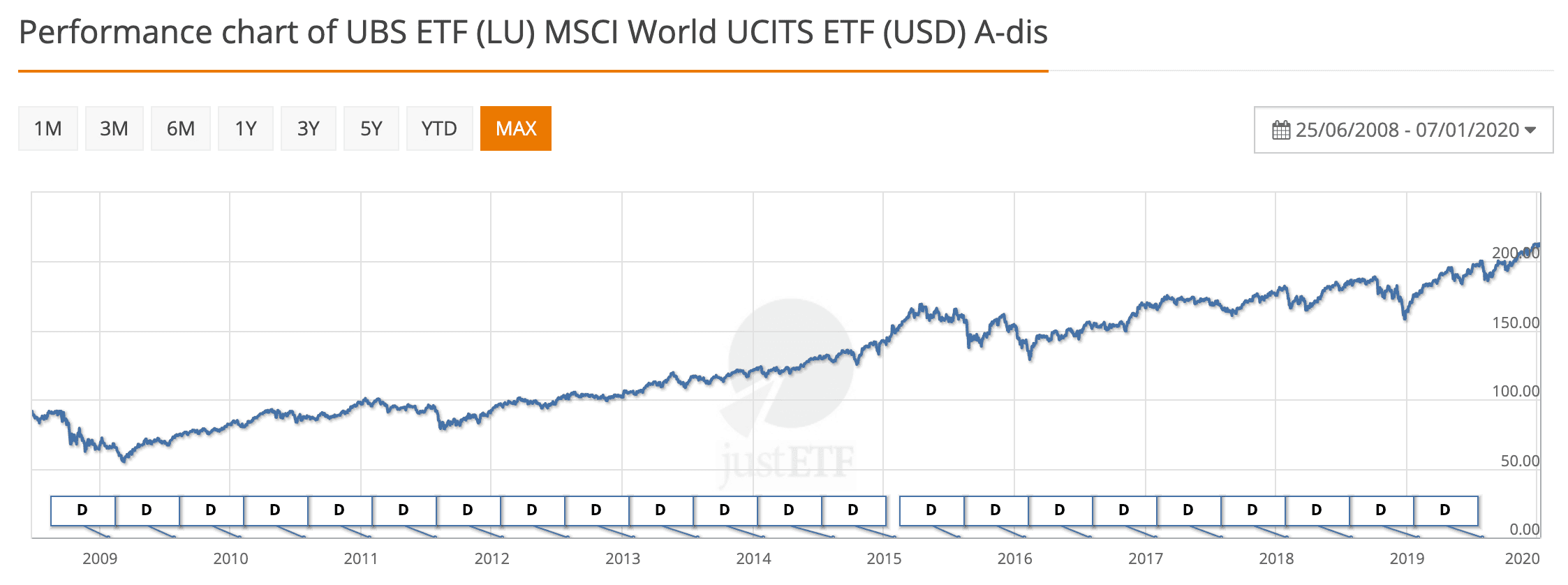

My decision to start investing in the MSCI World ETF back in 2016 was one of the best decisions of my life. I am explaining details in my ETF portfolio post, but in a nutshell, I believe there is no better and more cost-effective way to save & invest long term (e.g. for retirement) while earning some passive income from dividends.

Since I started investing in the MSCI World ETF in 2016, the value has increased by 43%. The shares that I bought originally for 145.09 EUR a piece – and kept on buying more shares of over the years – are today valued 212.77 EUR. Looking at below graph of the MSCI World ETF (UBS UCTIS), I would say it’s hard to find a better, more stable, cost-efficient, and diversified investment. Why? More in my ETF portfolio post. 🥳

After I had sold my DAX ETF in October (around 14,000 EUR), I am still waiting for a good moment to invest it in the MSCI World. I am hoping that the MSCI World is making a slight dip to allow me to buy 14,000 EUR worth at a slightly lower rate. As the ETF has nothing but climbed since October last year, I am also thinking about an ETF savings plan, which would allow to invest monthly and thus lower the risk of buying at the “wrong time”.

Overall, my ETF portfolio has been doing pretty incredible last year: Over the course of 2019, my ETF portfolio has gained 28,54% in value. Since I started in 2016, the value of my portfolio has even increased by 49.04%. In EUR terms, that means that the 63,000 EUR that I invested over time since 2016, are today valued 82,239 EUR and I received an additional 3033 EUR in dividends over the past three years (which I used and spent as passive income).

That’s it for my 2020 New Years Passive Income Update! I hope all of you are enjoy the first days of 2020. If you like to, please follow my journey on my Facebook Financial Freedom Journey page for more frequent updates. And as always: If you have any questions or comments, please pop them in the comment section below or get in touch via Facebook or Email.

All the best and happy January 2020,

Peter 👋