Here

I started with EstateGuru in early 2019 after I had followed the growth of the platform since 2016 and had decided to branch into property-back loans / real estate crowdfunding in order to further diversify my passive income investment portfolio.

Real estate crowdfunding and real estate lending is still a relatively new investment class. What I love about it is that it makes real estate investments and real-estate backed investments – an asset class which was traditionally only accessible to institutional investors and high net worth individuals to small investors – accessible to small investors like me. Jippie!

I joined EstateGuru and CrowdEstate at the same time.

I joined EstateGuru and CrowdEstate at the same time to be able to track and compare both platforms in terms of loan performance, loan availability, loan securities, and cash drag. It is too early to tell who the winner of the race is. Both platforms are great real-estate crowdfunding platforms and both platforms have excellent track records. EstateGuru is known for its securities and conservative investment opportunities (averaging 11% interest), whereas CrowdEstate is known for its high returns (average historical return of 20.54% – however with no buyback guarantee).

For now, the combination of CrowdEstate and Estate

This EstateGuru 2021 Review is 100% honest and truthful. I am not paid by Mintos or anyone else for sharing my experience. My intention with this review is to document my journey and to inspire others to build passive income through P2P, Real Estate Crowdfunding and ETF investments that run in the background without much work. At the end of this review, I am sharing my EstateGuru auto-invest settings.

EstateGuru Quick Facts

✅ Loans available at 10-12% interest.

✅ All loans are backed by a real estate collateral (first level/second level)

✅ Loans are real estate investments and business loans in different European countries.

✅ No BuyBack Guarantee but loans are backed by real estate collateral.

🔴 Getting familiar with platforms takes a bit.

🔴 No secondary market (selling of loans prematurely)

🔴 No risk ratings available

🔰 EstateGuru HQ: Tallinn, Estonia

🔰 Founded in 2013. Since then, 760 loans successfully funded with a historical return of 12.1% p.a.

About EstateGuru

EstateGuru is a Nordic online peer-to-peer lending platform established by property professionals facilitating short- and mid-term property loans. The cross-border marketplace offers flexible terms for borrowers and premium interest to its investors. The loans of 20,000 to 3,000,000 EUR facilitated through the EstateGuru platform are secured against property with a maximum LTV of 75%.

EstateGuru has an average historic interest rate of 12.16% as well as

With more than 24000 investors from 45 countries, EstateGuru is growing at more than 300% per year and has established itself in Estonia, Latvia

My Estateguru review and experience

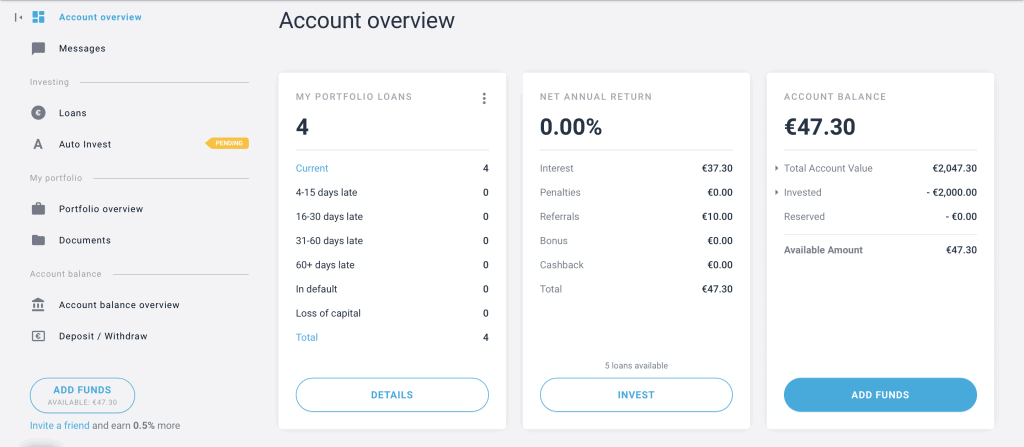

It is too early to have a definite opinion about EstateGuru. So far the platform has impressed me and after the initial adjusting of the auto-invest portfolio, things are on auto-pilot. My average interest rate on EstateGuru is 11.12% and I am receiving monthly interest payments.

The fact that loans are backed by first-rank collaterals lets me sleep without any worry at night. 😇

Getting started with EstateGuru: Opening a free investors account

Opening an account and getting started investing with EstateGuru was really easy:

- Register for a free investor account: Equipped with an ID, the identity verification process worked by webcam and took only two minutes. Here is the link: LINK

- Add funds: I added funds to my newly opened account through a regular SEPA bank transfer (which free of charge) from my regular bank account. The funds showed up less than 24 hours after I had made the transfer, which was fantastic!

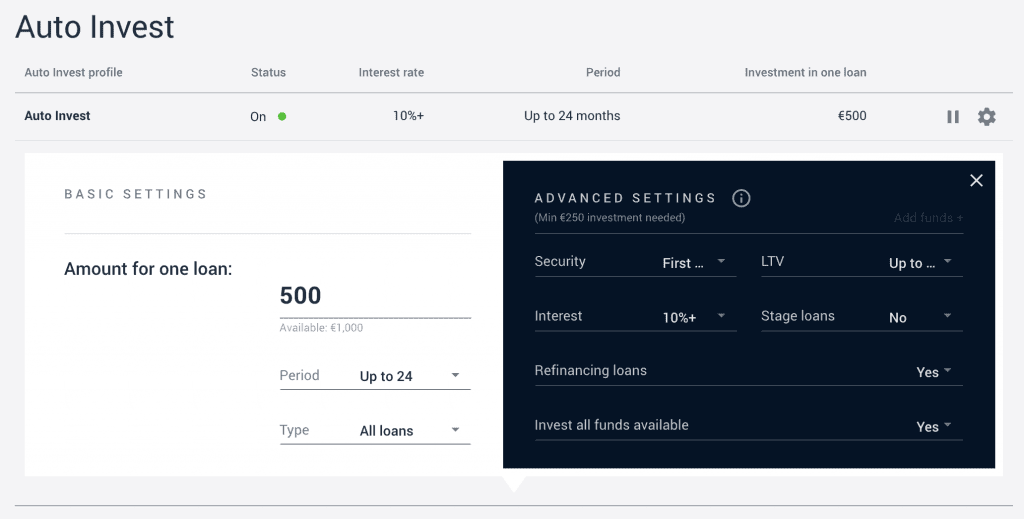

- Define auto-invest feature/portfolio: While it would be possible to browse all the loans on EstateGuru and get full background information about each loan, I prefer the auto-pilot using their auto-invest feature. Here are my auto-invest settings.

- Automated Syndication & Funding: Thanks to the auto-invest feature, this part of the process does not require any action. Phew! For those who are interested: During the financing round which can be open for up to two weeks, the auto-invest feat, as well as other manual investors commit loans until the project target is reached. If a project fails to attract sufficient funding, the loan commitment is returned. Once EstateGuru has carefully vetted both the borrower and their loan application and they’ve successfully met all our drawdown conditions, the funds are released and the loan goes ahead.

- Receive monthly interest payments ! 🥳

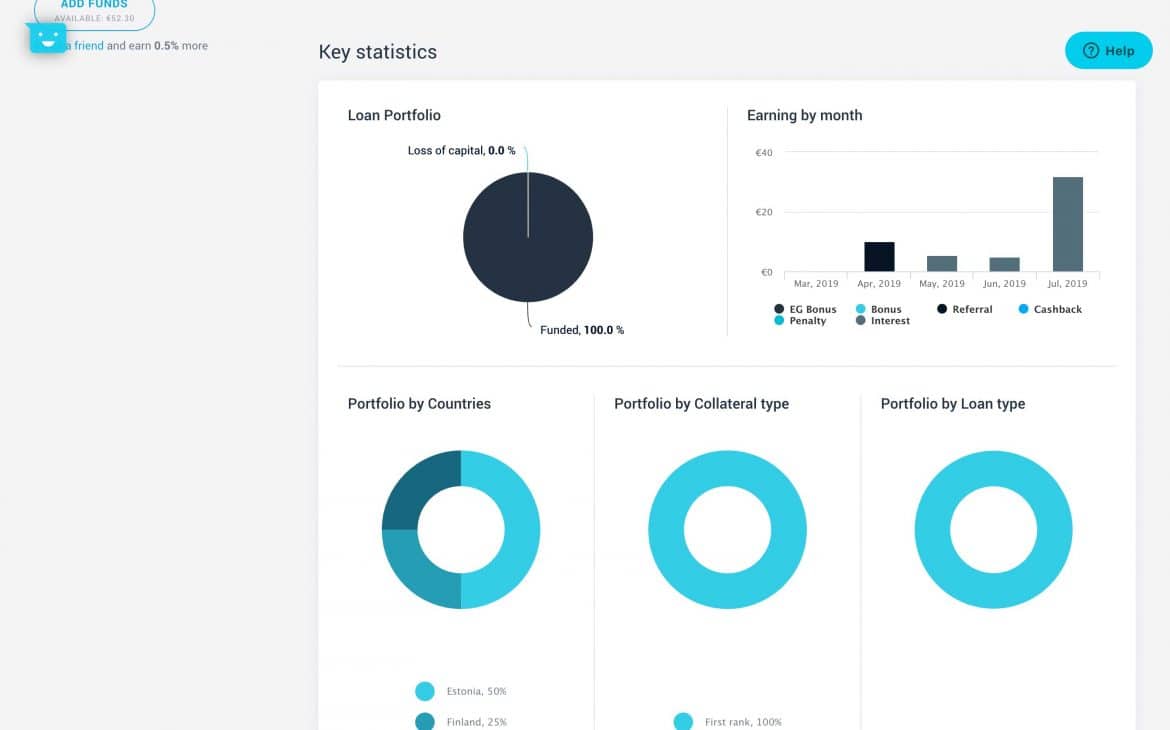

My Estateguru Dashboard

The EstateGuru dashboard is very simple and easy to use. It is well organized and allows users to get an overview at one glance. It reminds me of Mintos.

My EstateGuru auto-invest portfolio

EstateGuru has an auto-invest functionality, however, I find it somewhat confusing and it took me some time to understand.

Here’s a list of terms that can be adjusted in the auto-invest portfolio:

- LTV (Loan to Value Ratio): The LTV is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage. Typically, assessments with high LTV ratios are higher risk and, therefore, if the mortgage is approved, the loan costs the borrower more. LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property, expressed as a percentage. For example, if you buy a home appraised at $100,000 for its appraised value and make a $10,000 down payment, you will borrow $90,000 resulting in an LTV ratio of 90% (90,000 / 100,000). (Source)

- Bullet type loans: Bullet loans are loans where the full principal is paid in one large lump-sum payment at the end of their term. Interest is paid monthly but principal only once, usually at the end of the loan period. Full bullet loans accrue interest until the end and the borrower pays the total balance in the form of a large lump sum at maturity (principal + interest). (Source)

- First/Second charge security: In the event of default the first charge security receives all proceeds from the liquidation of the property until it is all paid off.

A second charge security is a type of subordinate mortgage made while an original mortgage is still in effect. Since the second mortgage would receive repayments only when the first mortgage has been paid off, the interest rate charged for the second mortgage tends to be higher and the amount borrowed will be lower than that of the first mortgage. (Source) - Refinancing loans: A refinancing loan is a loan made to pay off another loan. Companies (and individuals) seek refinancing loans in order to get a better loan deal: either lower interest rate, or lower payments, or to shorten the loan term, or just pay off a loan that was due at a specific date. (Source)

Below is a screenshot of my auto-invest portfolio. The “Amount for one loan’ is how much you want to invest per loan. Given that

As a conservative investor, I adjusted the other settings of the auto-invest as following:

- Security: First charge

- LTV: Up to 65%

- Interest: 10%+

- Stage loans: No

- Refinancing loans: Yes

- Invest all funds available: Yes

A nice feature of EstateGuru is that each time the auto-invest feature invests in a new loan, I receive an automated email with all details.

EstateGurus’s main competitors

Real estate crowdfunding: CrowdEstate

Peer-to-Peer lending: Mintos,

EstateGuru experience & review: Conclusion

While interest rates offered by projects on EstateGuru are slightly lower than on CrowdEstate, the securities offered by EstateGuru are really something great. For me – as a more conservative investor – the platform is ideal.

The track record of EstateGuru’s successful investments as well as their loans with first-level collateral

Bonus: Get 0.5% extra on all funds invested in the first 3 months.

EstateGuru currently has a campaign offering a 0.5% bonus on all investments you make within the first 90 days from your registration if you sign up through this link. You will not get this bonus if you sign up directly on EstateGuru.com. Signing up and setting up your first auto-invest portfolio takes only a few minutes and is totally free.

Comments

Trackbacks & Pingbacks

[…] settings. My auto-invest settings for each platform can be found here: Mintos, Swaper, Grupeer, EstateGuru, CrowdEstate. With everything set up, I am logging into my accounts once a month, to make sure […]