Here

I started with Swaper in August 2018. I had followed the launch and growth of the platform since 2016 and wanted to further diversify my passive income investment portfolio. And things have turned out really well.

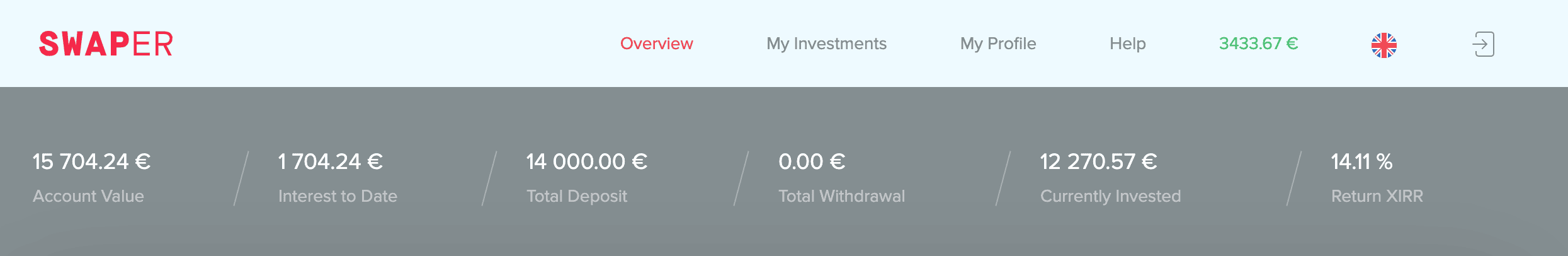

I earned more than 1,700 EUR since I joined Swaper 14 months ago.

This Swaper 2019 Review is 100% honest and truthful. I am not paid by Swaper or anyone else for sharing my experience. My intention with this review is to document my journey and to inspire others to build passive income through P2P, Real Estate Crowdfunding and ETF investments that run in the background without much work. At the end of this review, I am sharing my Swaper auto-invest settings.

Swaper Quick Facts

✅ Loans available at 12-14% interest

✅ Everything is fully automated

✅ All loans have BuyBack guarantee

✅ All loans are 1-month consumer loans from Spain, Denmark, Poland, Georgia and Russia

✅ Secondary market make selling of loans easy

🔴 Due to short-term loans, risk of cash-drag if not enough new loans are available

🔰 Swaper HQ: Tallinn, Estonia

🔰 Founded in 2016. Since then, more than 7 mio EUR in loans loans successfully funded

Swaper has a 2% bonus promotion for investors signing up through this link and investing more than 5000 EUR. This means instead of a 12% interest, you’ll earn 14% if your account balance is above 5000 EUR for three consecutive months! 💸!

To take advantage of this bonus offer, visit Swaper using this link and you will automatically qualify. There are no hidden costs or other disadvantages for you. The account is free and there are no fees 🥳.

About Swaper

Swaper specializes in short-term consumer loans, which are issued from their parent company Wandoo finance Group. All loans yield 12-14% interest annually (for investors who invest more than 5,000 EUR for three consecutive months the interest rate is automatically 14%).

All loans are on Swaper are covered by a BuyBack guarantee. That means that in case a borrower is more than 30 days late with short term loan repayment or 60 days late with long term loan repayment, Swaper covers the loan and pays the investor the invested principal and the accrued interest back. Thus, there is no rish for me as an investor of losing money from lenders that fail to repay their loans.

Loans are originating from Spain, Denmark, Poland, Georgia and Russia. With more than 2800 investors, Swaper is still relatively small. This being said, for me, Swaper offers an ideal way to diversify my P2P lending portfolio (together with Mintos and Grupeer) given their different loan countries and loan types.

My Swaper review and experience

I started with 7,000 EUR in 2018 and have since doubled my investment to 14,000 EUR on the Swaper platform. My monthly interest income is between 150 and 170 EUR (every month!) which is 13-14% p.a.. After the initial adjusting of the auto-invest portfolio, everything is on auto-pilot and requires no work. The platform works like a charm and so far I have only had good experiences with them.

Getting started with Swaper: Opening a free investors account

Opening an account and getting started investing with Swaper is really easy:

- Register for a free investor account: Equipped with a passport or Government ID, the signing up and verification process takes about two minutes. Rather than by webcam, Swaper requires you to upload a photo of your passport or ID. I took a photo with my smartphone which worked great. Here is the link: LINK

- Add funds: I added funds to my newly opened account through a regular SEPA bank transfer (which is free of charge) from my regular bank account. The funds showed up less than 2 days after I had made the transfer, which was fantastic!

- Set auto-invest feature/portfolio: While it would be possible to invest manually, I prefer using their auto-invest feature, which means that I don’t have to do anything by hand and I get new loans automatically when they become available. Here are my auto-invest settings

- Thats it! Following these three steps, I can lean back and start receiving monthly interest payments ! 🥳

My Swaper Dashboard

The Swaper dashboard is very simple and easy to use. It is well organized and allows users to get an overview at one glance. It reminds me of Mintos.

The Swaper Dashboard shows all important information, including:

- Account Value

- Interest to Date

- Total Deposit

- Total Withdrawal

- Currently invested

- Currently not invested (awaiting to be invested)

- Return XIRR

My Swaper auto-invest portfolio

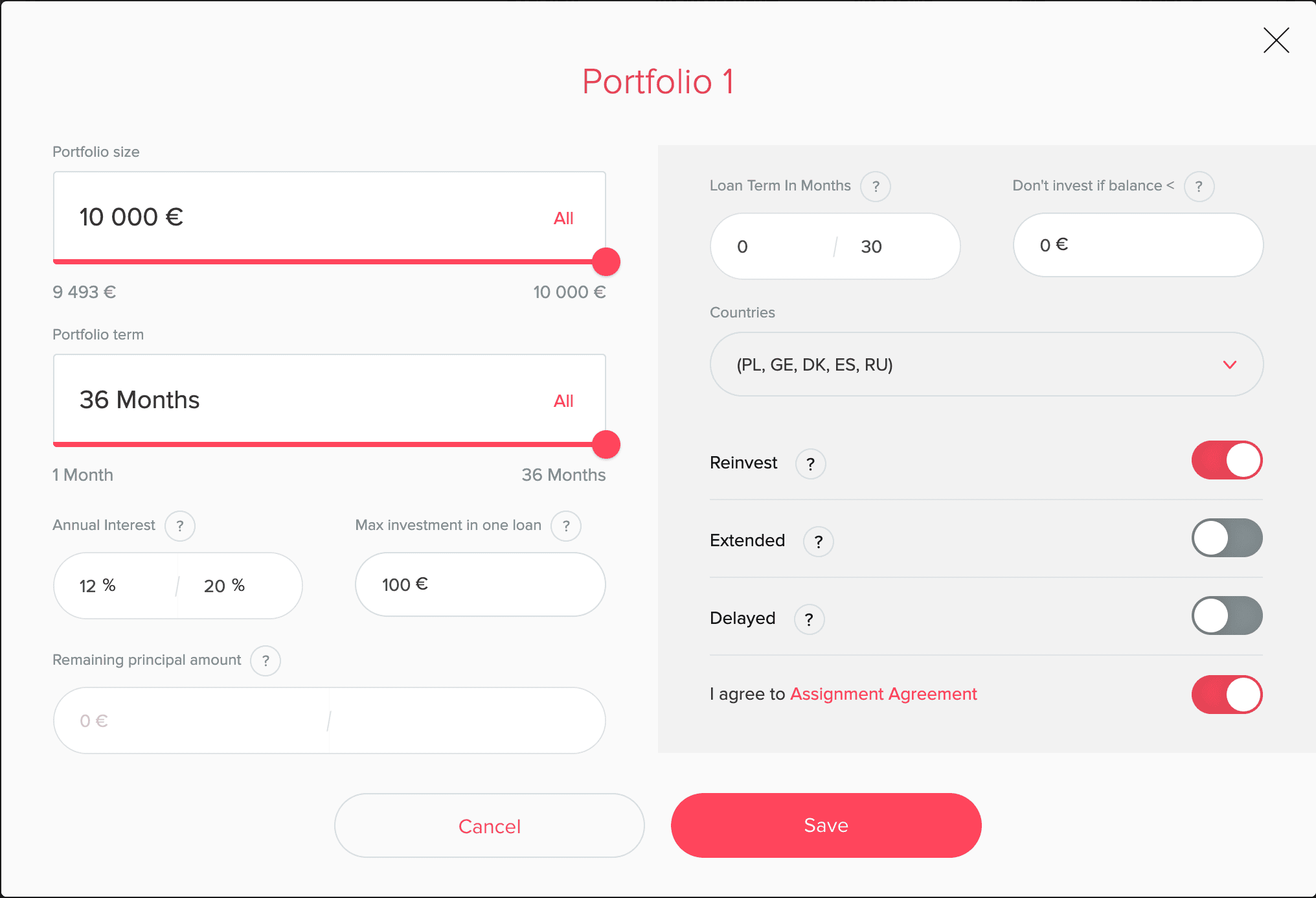

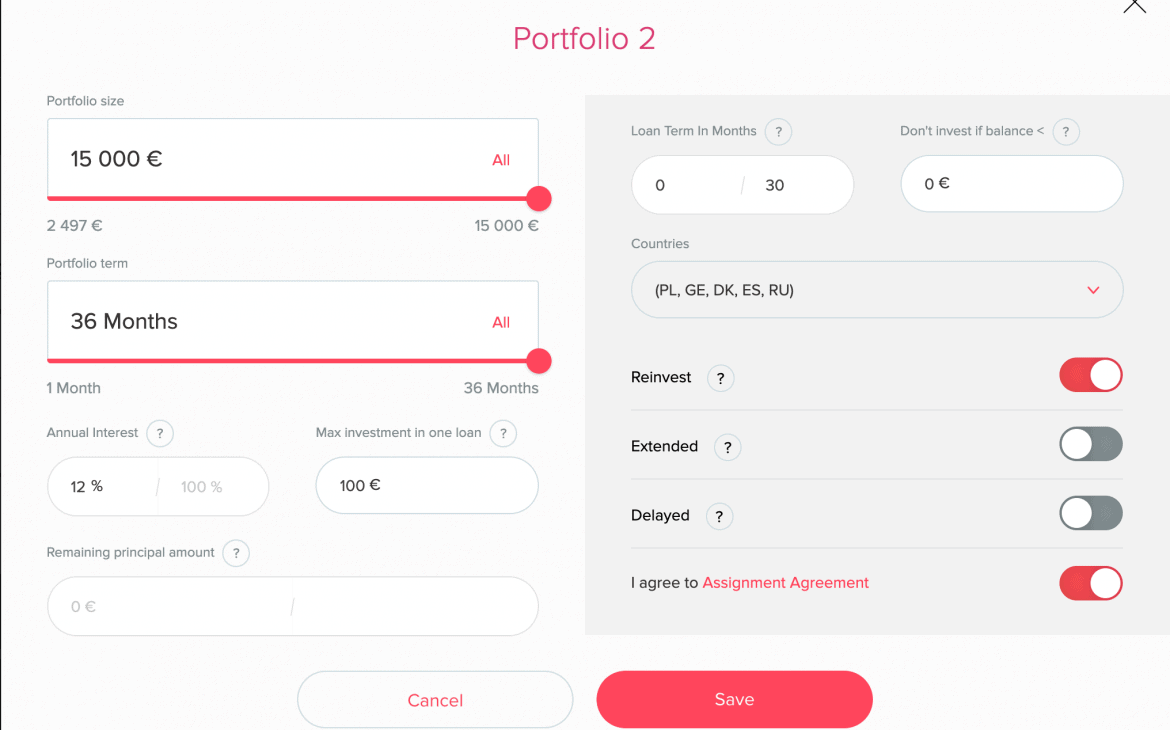

Swaper has an auto-invest functionality which makes investing super easy and fully automated. Once set up, the auto-invest does all the work and does not require any “manual” investing. I receive an overview email every Monday morning which informs me about earned interest and account balance.

Here’s a list of settings that can be adjusted in the auto-invest portfolio:

- Annual interest: This is the monthly interest that you are will to invest in. I set mine to 12-20%.

- Max investment in one loan: The maximum amount that you are willing to invest in one loan. As all loans are secured with BuyBack guarantee and thus if the borrower fails to pay back, Swaper will cover the loss, I set this setting to 100 EUR per loan.

- Loan term in Months: While at the moment all loans are 30-day loans, this might change in the future if Swaper decides to bring other loans to investors. I set mine to 0-30 months. Given the secondary market, loans can be sold early anyways.

- Reinvest: Yes, I do want to automatically reinvest once the 30-day loan has been paid back.

- Extended/Delayed: No, I do not want to invest in delayed or extended loans. To my knowledge, Swaper does not pay interest on extended and/or delayed loans, so I don’t want to invest in them. It’s also a way to reduce risk for me.

Below is a screenshot of my auto-invest portfolio. As one auto-invest porfolio goes only up to 10,000 EUR, I have two seperate auto-invest portfolios with identical settings.

Swaper’s main competitors

Peer-to-Peer lending: Mintos, Grupeer

Real estate crowdfunding: CrowdEstate, EstateGuru

Swaper experience & review: Conclusion

For me, Swaper is an interesting and reliable platform to diversify my investment portfolio. With interest rates at 14% with BuyBack guaranteee, the platform yields reliable monthly passive income. At times there are weeks when some of my invested money is awaiting to be invested, but that is usually less than 10% of my total investment. Given the high 14% interest rate on loans, in comparison to other platforms (Swaper, Grupeer), things even out and my average monthly returns over the past 12 months have been 13.12%.

As of today, I have 14,000 EUR invested on Swaper (monthly interest returns of 120 – 150 EUR) and I am planning to add more in 2020.