After 4 years of blogging about my passive income on this blog, I decided to give myself a break. This is my last update for a while.

Why the break?

Not because things with my passive income streams didn’t work out – in fact, the opposite, see below. More because I lost the joy of writing these updates and sharing my journey.

And, being very honest, I feel less certain about the investment choices that I made over the past years than I felt before the COVID-19 pandemic.

This being said, here is my final update.

December 2022 Passive Income Update. Starting to reflect on the year, the past months have been nothing but incredible. Filled with travel, new and old places, new skills, and time spent outdoors. One of the biggest highlights of the past months is that I learned paragliding and bought my own equipment.

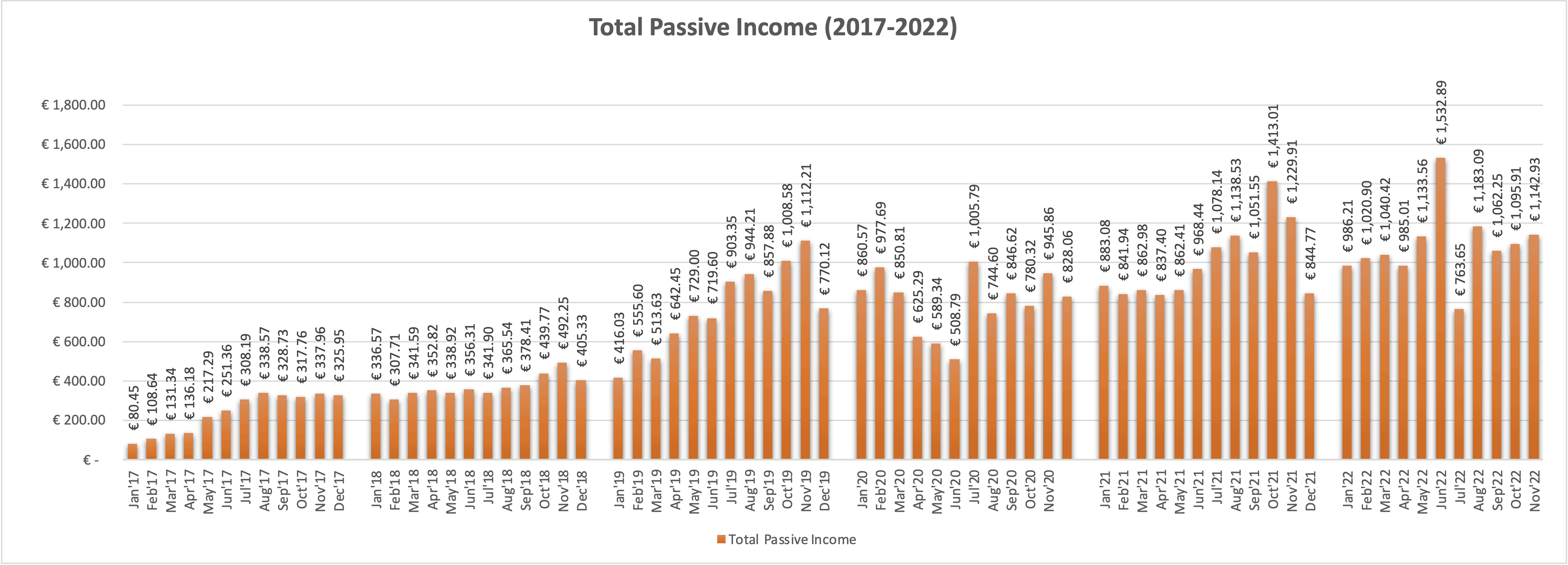

My passive income in October was 1,095.91 EUR (1,150 USD) and in November was 1,142.93 (1,200 USD), which is about 80% of my goal of 1,500 USD in monthly passive income.

Here is a breakdown of my November 2022 passive income:

– P2P lending: 597.09 EUR

– Real Estate Lending: 165.55 EUR

– ETF Dividends: 107.01 EUR

– Stock Photos/Videos: 273.28 EUR

Passive Income Breakdown:

P2P & Real Estate Lending Overview – Passive Income Update

As part of my December 2022 passive income update, here is a quick overview of passive income streams from three (3) P2P Lending and one (1) Real-estate P2P Lending platform that I am currently investing in.

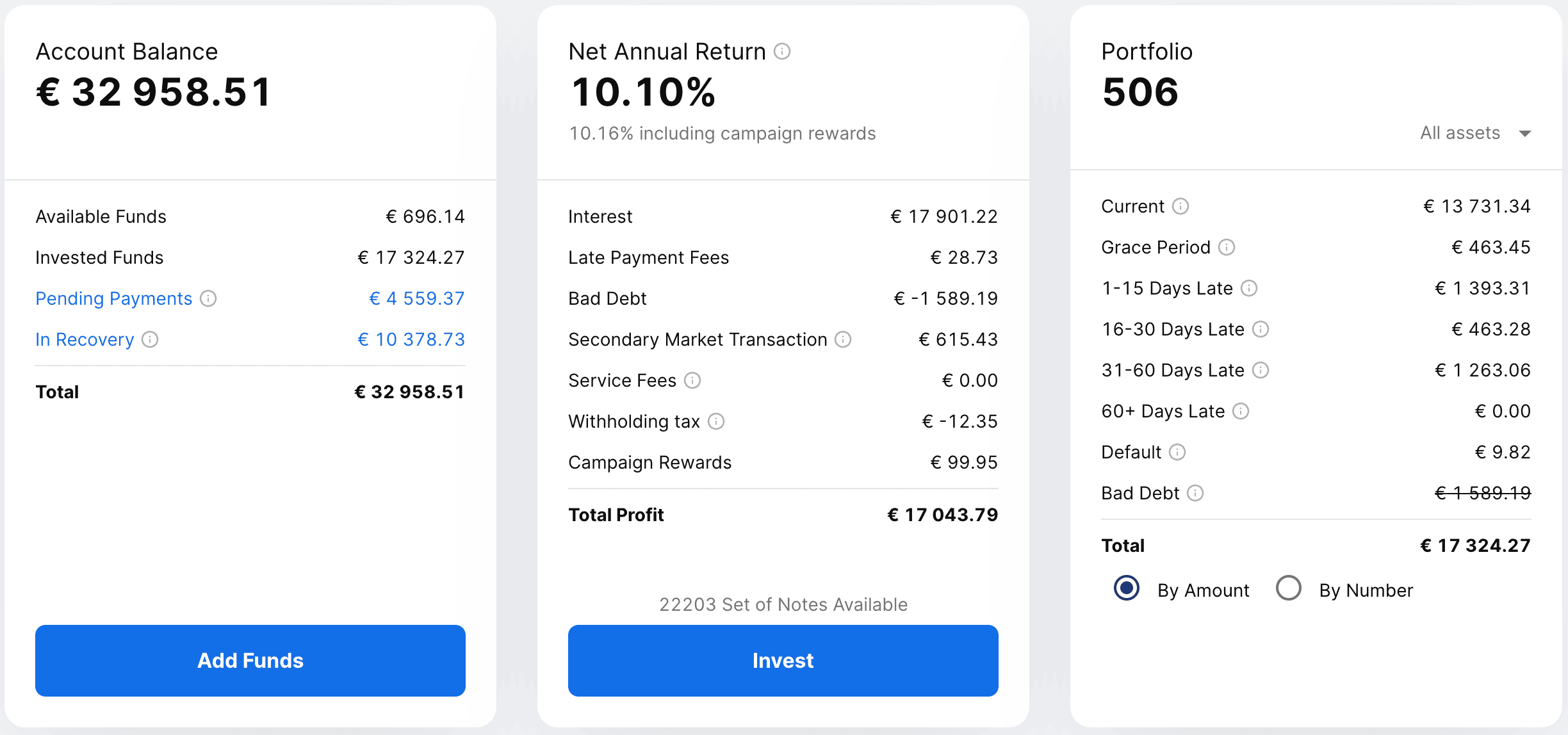

Mintos

Mintos: I decided to gradually withdraw my investments from Mintos. The ongoing Ukraine conflict has severe impacts on my portfolio as payments from loans in Ukraine and Russia are on hold. In addition, one of my Turkey-based loan originators is struggling due to the high inflation in Turkey. As a result, about 10,400 EUR of my portfolio is “in recovery” and 4,500 EUR are “pending payments”.

I put my auto-invest on hold and have started withdrawing funds as they become available. Over the past months, I have withdrawn 18,600 EUR which worked very smoothly and the funds arrived in my bank account within 1-2 working days.

My interest income on Mintos in November was 307 EUR (=self-calculated interest rate of 9.73 % p.a.).

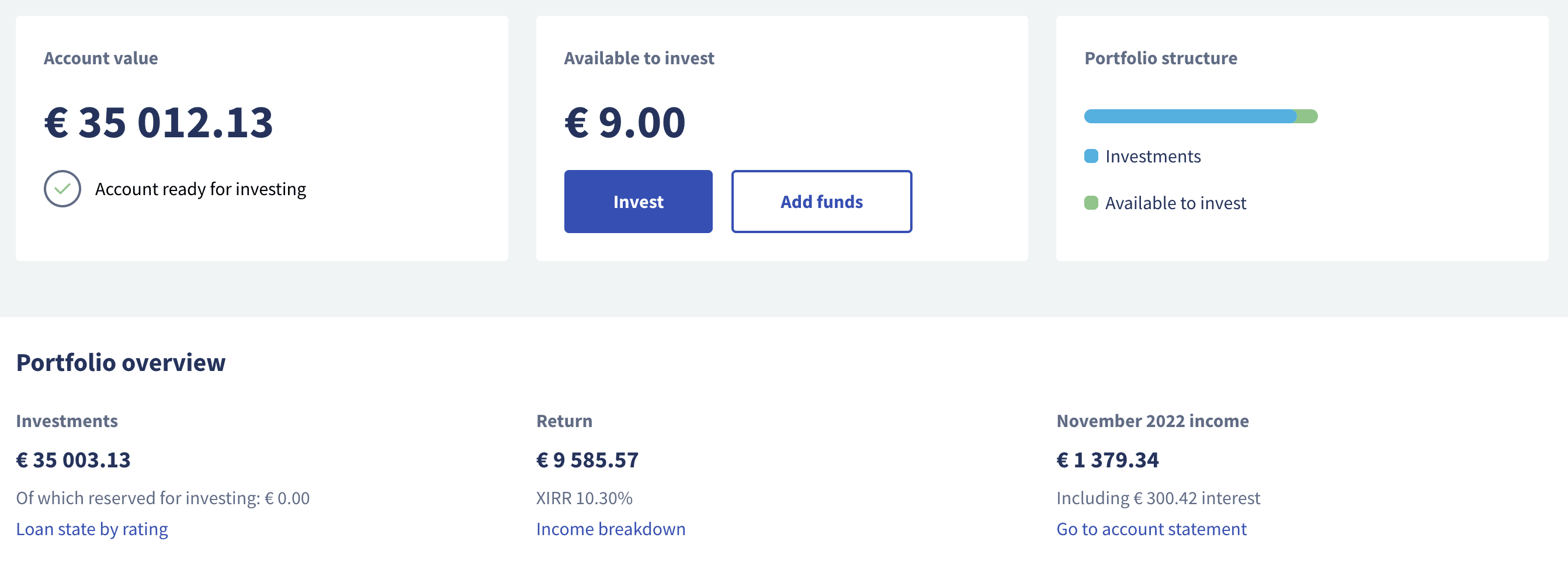

Twino

Twino: I remain invested on Twino! My total investment on Twino is 28.500 EUR. My monthly interest in November was 289.29 (= 9.99% p.a.).

After 6+ years of investing in the Twino platform, I can say my experience with the platform has been really great. I have been very happy to have seen that Twino has officially obtained its investment brokerage license from Latvia’s Financial and Capital Market Commission (FCMC) and has thus become a regulated investment platform (providing me as an investor with greater security and transparency).

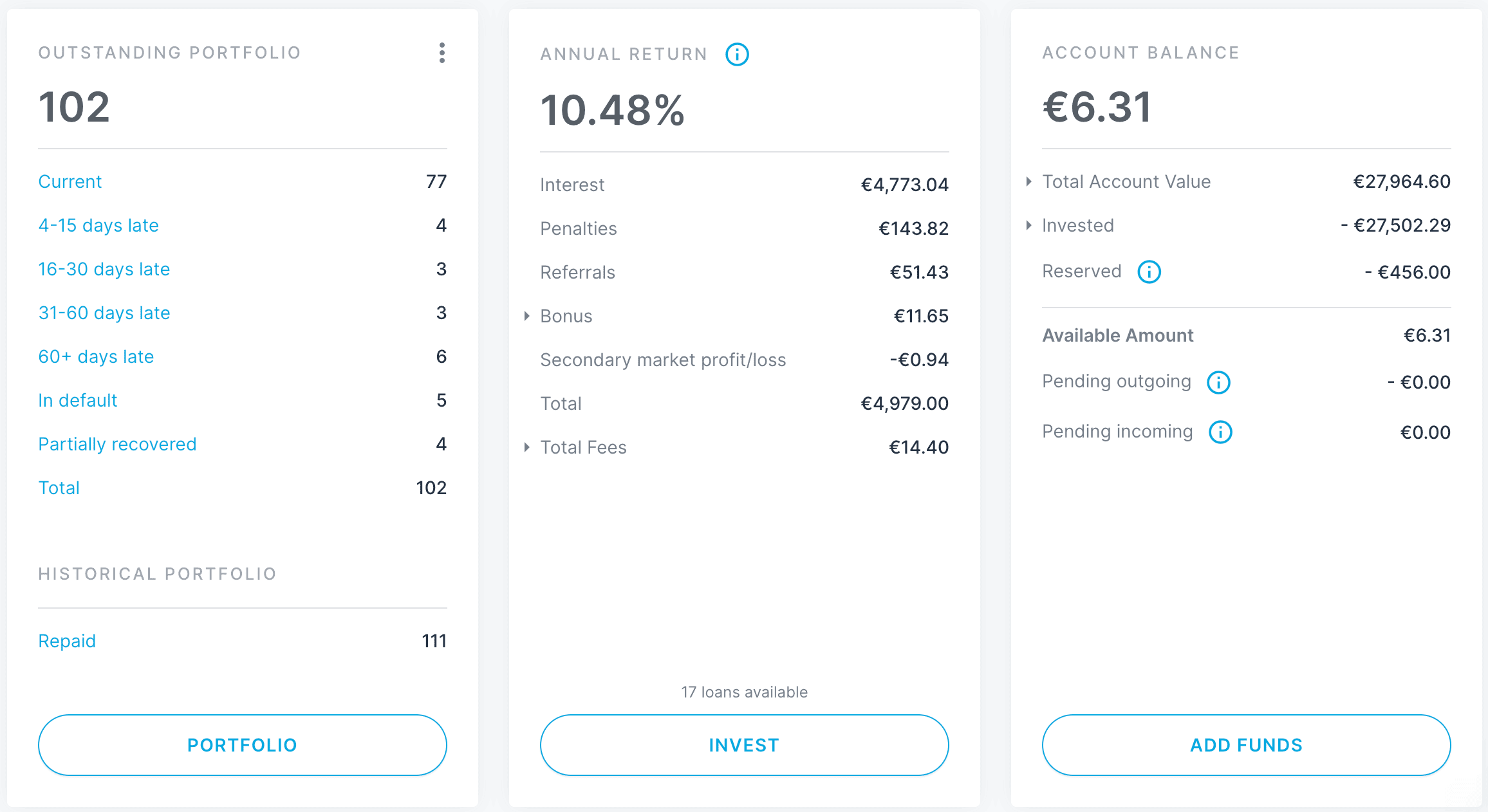

EstateGuru

EstateGuru: Besides Mintos and Twino, EstateGuru is another key investment pillar and passive income stream of mine. My total investment on EstateGuru is 23,000 EUR which is invested in 102 real estate projects in Estonia, Finland, Lithuania, Latvia, Germany, Sweden, and Spain.

My average interest rate on EstateGuru is 10.48% p.a. For me, EstateGuru is a great platform to diversify my risk by investing in real estate loans that are secured with a first-rank mortgage (physical security). Since my first investment on EstateGuru in 2019, 102 projects have successfully and fully been repaid. 16 loans are currently behind schedule and 5 loans are in default, and 4 have been partially recovered, which are numbers that I am ok with.

As I mentioned in previous posts, almost all my loans on EstateGuru are either bullet or full bullet loans, which means that either principals or both interest+principals are being paid in full at the end of the loan period. This past month, I received 165.59 EUR in interest payments.

Exchange-Traded Funds (ETF) Update – April and May 2022 🥳

Investing in the MSCI World ETF is an incredibly rewarding and cost-effective way to save & invest long-term (e.g. for retirement) while earning passive income from dividends.

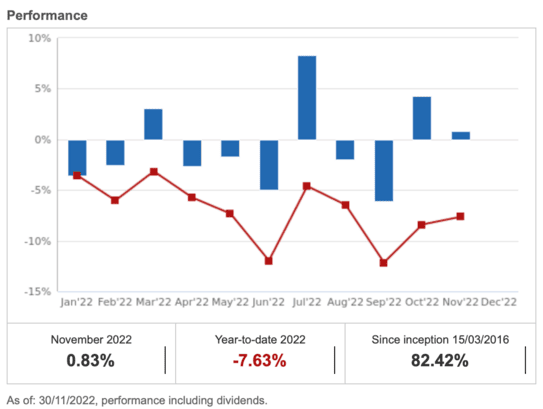

Since I started investing in the MSCI World ETF in 2016, the value of my ETFs has increased by 82.42% (and this is despite the coronavirus and Ukraine-related shock in stock markets last year).

My 1,000 EUR monthly ETF savings plan

I increased my automated monthly ETF MSCI World savings plan to 2,000 EUR per month. The savings plan is fully automated, runs in the background, and buys MSCI World ETFs worth 2,000 EUR on the 15th of every month. It’s a fantastic way of cost-averaging and keeps me committed to my financial savings goals. Thanks to my savings plan I have saved 36,000+ EUR (+ value gain) since I started it. 🥳

That’s it for my final blog post for the time being! The past 4 years have been a truly incredible journey. Blogging about my passive income journey has not only helped me to stay committed and accountable on my journey toward financial freedom – but it helped me to look back and reflect at the end of every month.

Reflect on where and with who I spend time, what parts of it I enjoyed, and which ones I didn’t. It helped me to collect memories at the end of every month, and it inspired me to continue living a life of financial freedom.

Thank you for having been a part of this incredible journey.

Peter 👋