April is over, and here are my numbers. I worked in a 9-to-5 office environment for the past 8 weeks (on assignment in Myanmar) and I have learned – once again – how important it is to build passive income. Passive income allows me to be financially free and to make free decisions in terms of where and how much I want to work.

Something that really shocked me about the past 8 weeks working Monday to Friday nine to five, is that they have passed in no time. Days at the office have left only a handful of memories. Weeks have flown by, and weekends felt too short to really do something meaningful. Looking back, it feels a bit like someone owes me my time. Except that there is no one.

“Because in the end, you won’t remember the time you spent working in the office or mowing your lawn. Climb that goddamn mountain.”

― Jack Kerouac

There is more to life than just working a 9-to-5 job. More to life than days spent at the office. The experience over the past weeks inspired me to continue building passive income, to be able to make financially independent decisions. 🚀

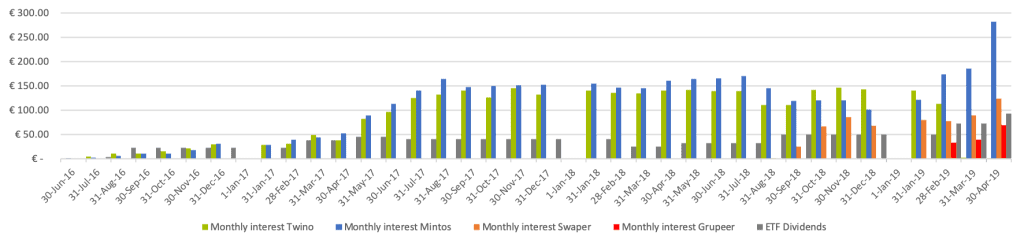

Passive Income Overview – April 2019

Now, on to my passive income numbers for April 2019:

My total passive income in April: 569.79 EUR*

*I decided to start including my ETF dividends in the monthly passive income starting this month. My April dividend was 92.67 EUR.

P2P Overview – April 2019

| P2P Lending Platform | Apr'19 Interest Income | Apr'19 XIRR | Total Investment | Current Value |

|---|---|---|---|---|

| Mintos | € 282.76 | 11.88% | € 23,000.00 | € 28,846.51 |

| Twino | € 1.59 | 6.32% | € 0 | € 303.79 |

| Swaper | € 124.00 | 12.95% | € 11,000.00 | € 11,617.54 |

| Grupeer | € 68.77 | 13.58% | € 9,000.00 | € 9,154.71 |

Mintos: Things are going very smooth. No cash drag and great loan performance. Mintos remains my favorite platform. 11.88 % XIRR in April.

Twino: I left Twino earlier this year and did not regret it.

Grupeer: Still relatively new to the platform but I am starting to see the perks of

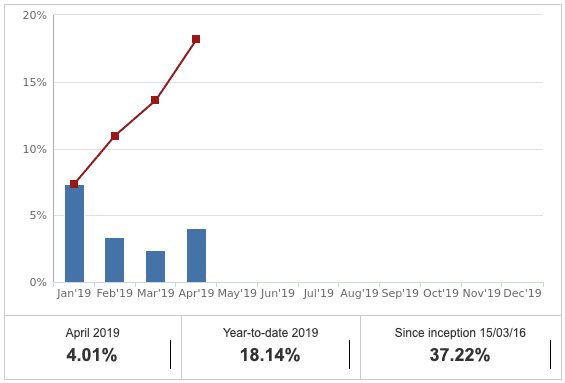

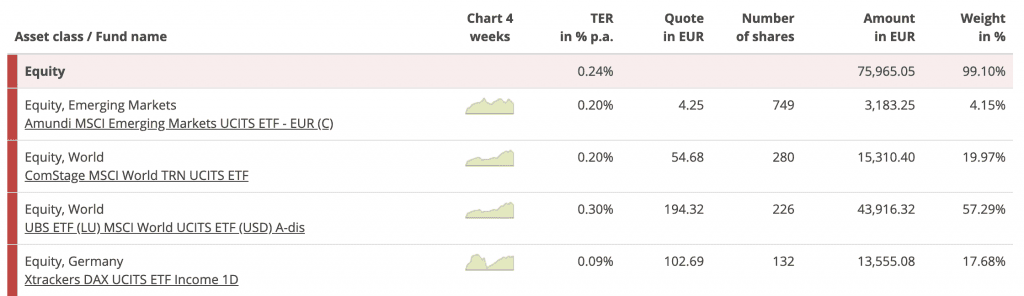

ETF Overview – April 2019 🥳

The MSCI World ETF is running great and April was a good month. Overall, my ETF portfolio has gained 18.14 % in value since the beginning of the year (37.22 % since I first started investing in March 2016). The strong performance over the past few weeks lets me believe that there will be some ‘course corrections’ later this year. For new investors, I would either wait a bit or apply with 4-cycle investment approach.

Financial Transactions in April 2019

- Grupeer: 🌱 + 3000 EUR

🔰 Overview of all my transactions.