Here is my June 2021 Passive Income Update. Summer has arrived in Turkey and restaurants and coffee shops reopened just in time. I spent most of the past month in the south of Turkey, enjoying the Mediterranean coast with its unique landscapes and incredible views. Check out the photos of this blog post!

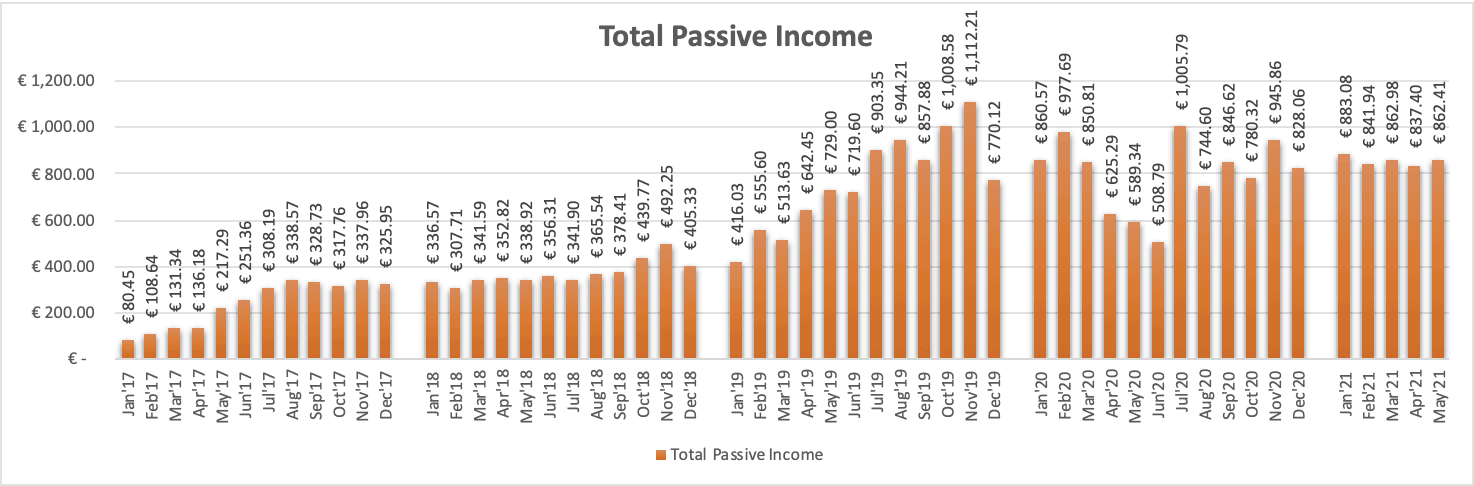

I am getting great use out of my new inflatable SUP paddleboard (it’s so much fun!). While I enjoyed the weather and crystal clear waters on my paddleboard, I earned 862,41 EUR (1,049.25 USD) in passive income in May 2021:

– P2P lending: 509.92 EUR

– Real Estate Lending: 134.02 EUR

– ETF Dividends: 66.79 EUR

– Stock Photos/Videos: 151.68 EUR

Passive Income Breakdown:

P2P & Real Estate Lending Overview – June 2021 Passive Income Update

As part of my June 2021 passive income update, here is a quick overview of passive income streams from three (3) P2P Lending and one (1) Real-Estate P2P Lending platform that I am currently investing in.

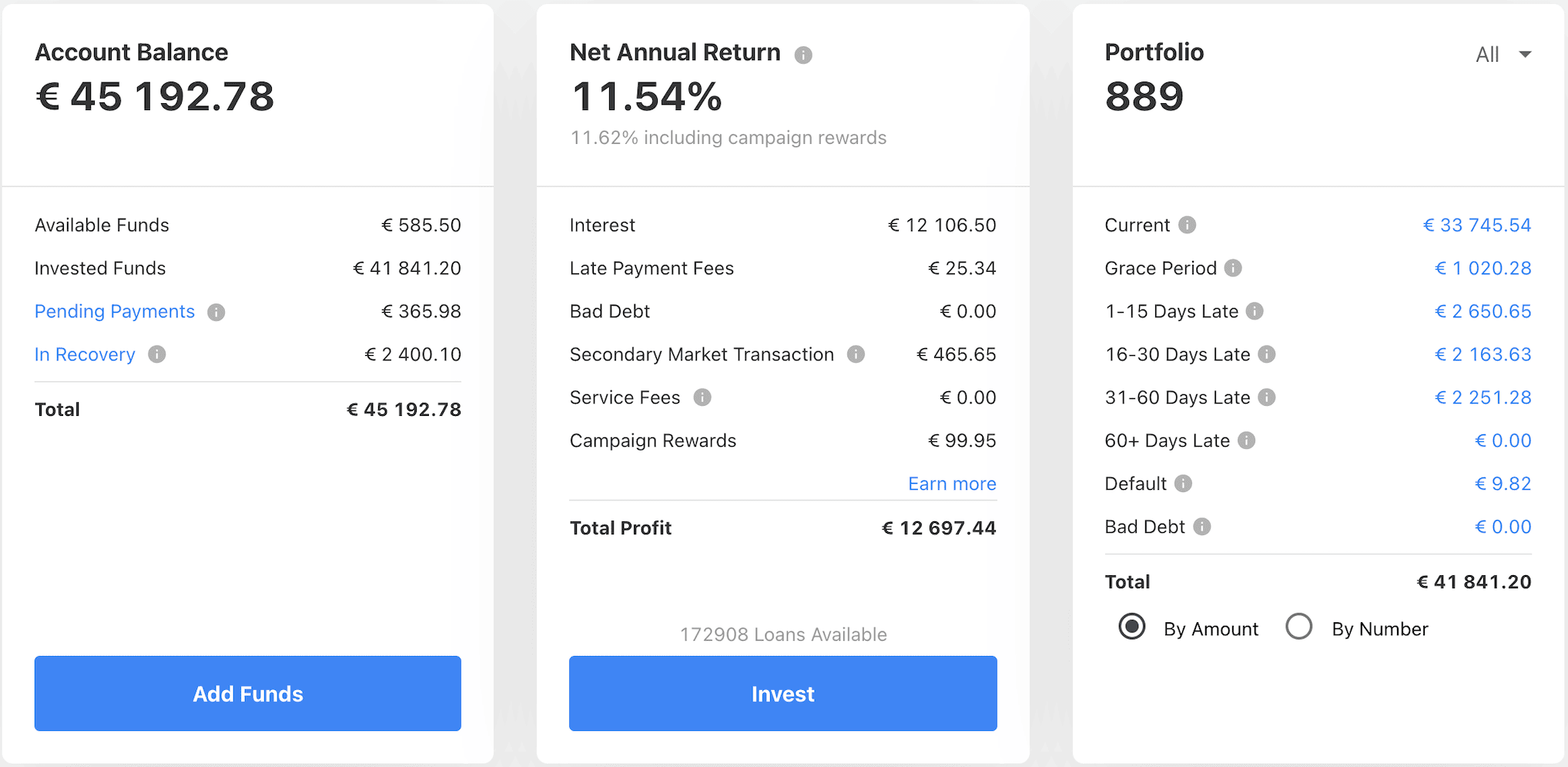

Mintos: The 32,100 EUR that I invested on Mintos gradually over the five past years, have since grown to 45,192.78 EUR, showing that I have earned more than 12,000 EUR in interest through the Mintos platform. While some loan originators are struggling (= about 2,400 EUR of my portfolio is currently “in recovery”), I am more than happy with the performance of Mintos.

As of June 2021, I am auto-invested in loans from 55 loan originators (all with ratings 7-10) in 21 countries. Certain loans are up to 60 days delayed (especially now during COVID-19), but all loans have a buyback guarantee which is working well.

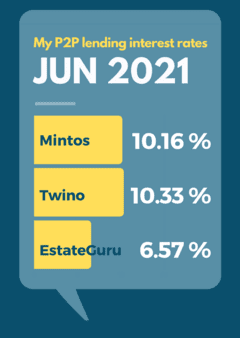

My auto-invest portfolio is investing in loans with ratings 7, 8, 9, and 10. I adjusted my auto-invest portfolio settings to include all new loan originators with ratings 7, 8, 9, and 10, and selected “set equal” under diversification settings. As a result, my interest income on Mintos in May was 379.26 EUR (=self-calculated interest rate of 10.16% p.a.).

Twino: Another great month for Twino! I added +8.000 EUR to Twino last month (May 2021) and my total investment on Twino is now 21.500 EUR. Most of the new funds have been auto-invested and my monthly interest in June was 130.66 EUR (= 10.33% p.a.).

The average loan duration of my loans on Twino is currently 5 months. All loans are with a Buyback and Payment guarantee.

After six years of investing on the Twino platform, I can say my experience with the platform has been really great. Twino is not only a solid platform in terms of returns but they also handled the COVID-19 crisis really well, as well as officially applied for an investment brokerage license from Latvia’s Financial and Capital Market Commission (FCMC) – which gives me confidence.

What else? TWINO has a referral program. New investors who sign up with this link (https://financialfreedomjourney.eu/Twino) and invest at least 100 EUR, will get a 15 EUR bonus (as well as I receive a 15 EUR bonus).

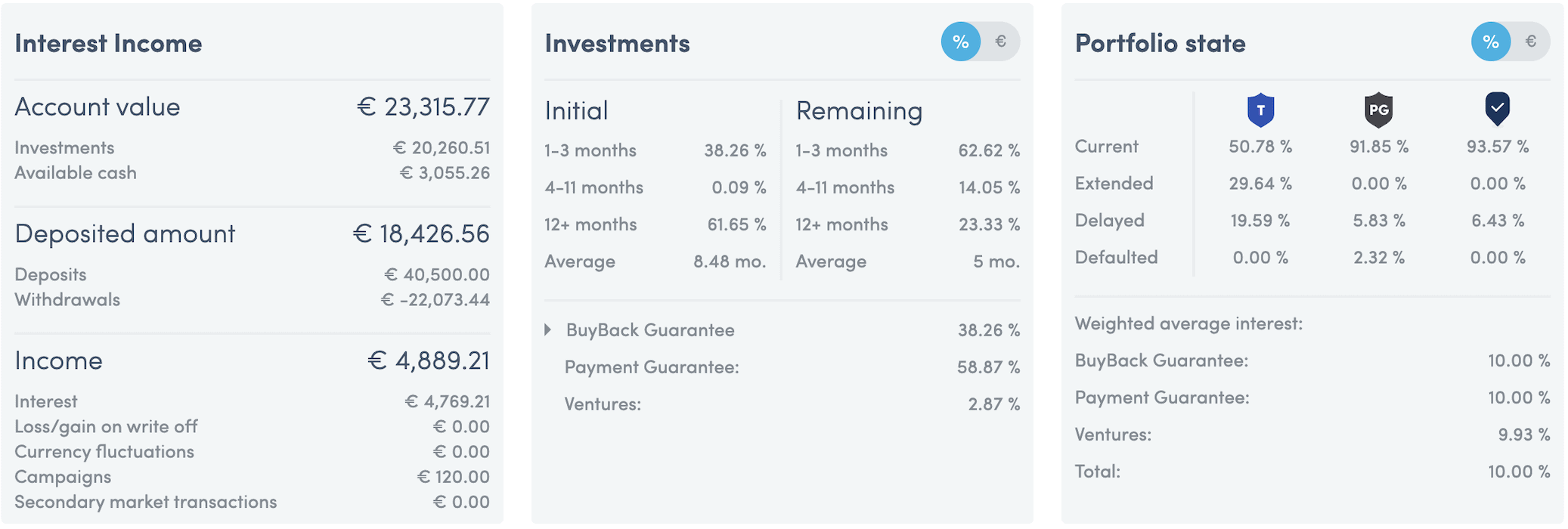

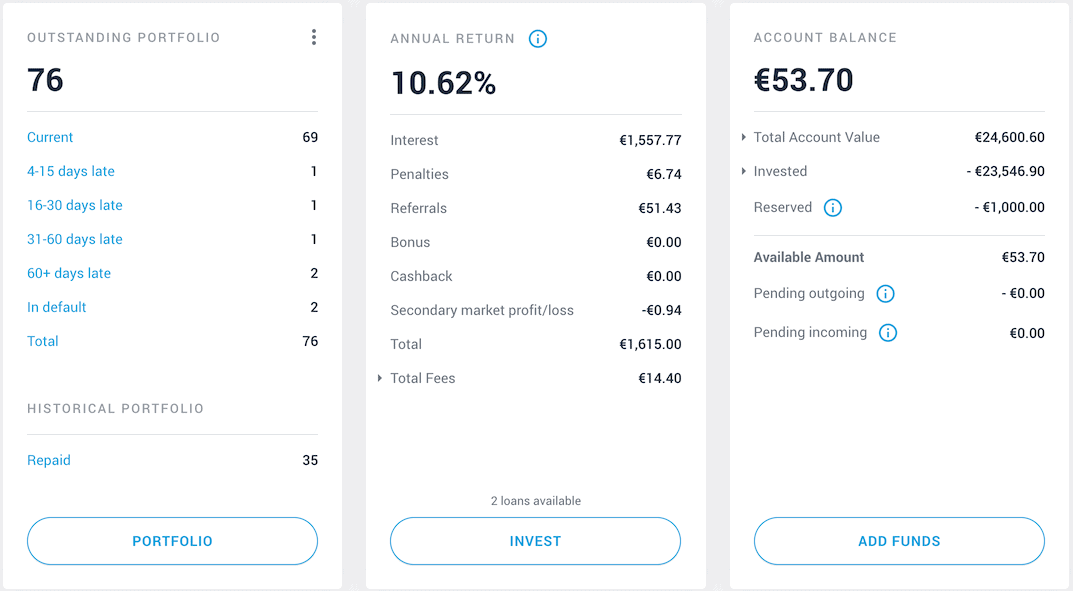

EstateGuru: Besides Mintos and Twino, EstateGuru is another key investment pillar and passive income stream of mine. After I added +7,000 EUR to EstateGuru in early March, my total investments on EstateGuru are 23,000 EUR which are invested in 76 real estate projects in Estonia, Finland, Lithuania, Latvia, Germany, Sweden, and Spain. 🥳.

My average interest rate on EstateGuru is 10.62% p.a..For me EstateGuru is a great platform to diversify my risk by investing in real estate loans that are secured with a first-rank mortgage (physical security). Since my first investment on EstateGuru in 2019, 35 projects have successfully been repaid. 7 loans are currently slightly behind schedule (4-138 days late) and 2 loans are in default process.

As I mentioned in previous posts, almost all my loans on EstateGuru are either bullet or full bullet loans, which means that either principals or both interest+principals are being paid in full at the end of the loan period. Unfortunately, that means that some months I receive large interest and principal payments, some months I receive nothing. This past month (May 2021), I received 134.02 EUR in interest payments.

What else? My EstateGuru review explains details as well as shows how to receive a 0.5% bonus as a new investor in the first three months. EstateGuru currently has some new loans available (11.5% p.a. & 12.00% p.a.).

Exchange-Traded Funds (ETF) Update – May 2021 🥳

Even in times of COVID-19, I hold onto my opinion that investing in the MSCI World ETF back is one of the best and most cost-effective ways to save & invest long-term (e.g. for retirement) while earning passive income from dividends.

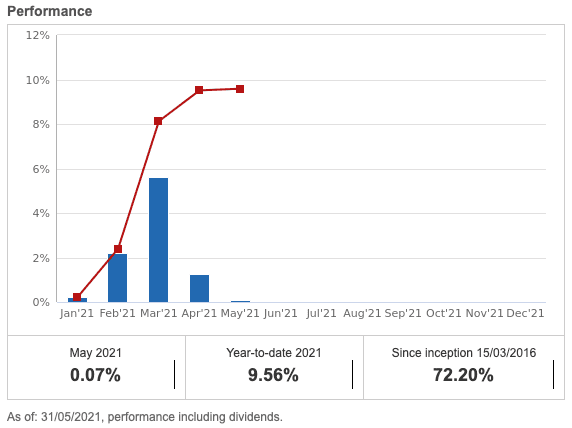

Since I started investing in the MSCI World ETF in 2016, the value of the ETF has increased by 72.20% (and this despite coronavirus-related shock in stock markets last year). The shares that I bought originally for 145.09 EUR apiece are currently valued at 244.26 EUR. Read more in my ETF portfolio post.

As of today, I am holding 126,459.51 EUR in MSCI World and MSCI Emerging Market ETFs. The value of my ETF portfolio increased by 0.07% in May 2021 (just in one month).

My 1,000 EUR monthly ETF savings plan

I started an automated monthly 1,000 EUR ETF MSCI World savings plan in January 2020. It’s fully automated, runs in the background, and keeps buying MSCI World ETFs worth 1,000 EUR on the first of every month. It’s a fantastic way of cost-averaging and keeps me committed to my financial savings goals. Thanks to my savings plan, since I started it, I have saved 17,000 EUR. 🥳

More about my ETF savings plan and why it was such a great idea to go back to an automated saving plan in this blog post.

That’s it for my May 2021 Passive Income Update! If you are interested in more frequent updates, please follow my journey on my Facebook page at Financial Freedom Journey.

And as always: If you have any questions or comments, please pop them in the comment section below. Or get in touch via Facebook or Email.

Stay healthy and enjoy the rest of May!

Peter 👋