Here is my Exchange-traded funds (ETF) portfolio. I started investing in 2016 when I was in my mid-20s and my employer enquired what my retirement savings plan looks like (read more here). I did extensive research and it turns out that a number of ETFs (see below) are an ideal “conservative” investment to save for retirement while also earning passive income. That sounds perfect right?

My ETF Portfolio

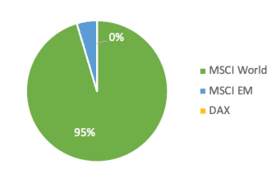

- 95% World Index: The MSCI World is one of the biggest World Indexes and spreads its holdings across 1,600 of the world’s largest companies from the 23 most advanced economies. It’s essentially “investing in the world” and thus avoids excessive exposure economic fluctuations of single countries. The MSCI World ETF is globally diversified and thus immunizes investors against the risk of a single company going bust. I decided to invest in two different World ETFs:

- 1. The UBS ETF (LU) MSCI World UCITS ETF (USD) A-dis, a distributing (dividends!) physical ETF with a Total Expense Ratio (TER = annual cost of holding the ETF) of 0.30%. Looking at the historic growth chart, one can easily see that this is a slowly growing, low-risk, stable ETF with an average growth rate of 4-6% per year.

- 2. The ComStage MSCI World UCITS ETF, a distributing (dividends!) synthetic ETF, with a slightly lower TER of 0.20% and which was offered as a free ETF saving plan by my bank at the time.

- 5% Emerging Market Index: While emerging markets experience greater volatility, they are expected to deliver greater growth in the long term. I hence included a 4% share of the Amundi MSCI Emerging Markets UCITS ETF EUR (A) in my portfolio. The MSCI Emerging Markets is an accumulating synthetic ETF that includes 1100+ companies from 26 emerging markets (including Tencent, Alibaba, Samsung). Its TER is 0.20%.

- 0% DAX Index: I previously held ETF shares of the Xtrackers DAX UCITS ETF Income 1D, a replicate ETF, mirroring the German DAX, with a TER of 0.09%. I have to admit that I fell for the home country bias when buying them. I sold them in late 2019.

ETF’s in my portfolio

| Group | ETF | ISIN | TER | Replication | Currency | Distribution |

|---|---|---|---|---|---|---|

| World Index | UBS ETF (LU) MSCI World UCITS ETF (USD) A-dis | LU0340285161 | 0.30% | Physical | USD | Distributing |

| World Index | ComStage MSCI World UCITS ETF | LU0392494562 | 0.20% | Synthetic | USD | Distributing |

| Emerging Market Index | Amundi MSCI Emerging Markets UCITS ETF EUR (A) | LU1681045370 | 0.20% | Synthetic | EUR | Accumulating |

| SAVINGS PLAN World Index | Lyxor MSCI World UCITS ETF D-EUR | FR0010315770 | 0.30% | Synthetic | EUR | Distributing |

How did I start?

I was researching ways to save for retirement. A very adult topic and something every person becoming an

I continued my research and learned about Exchange-traded funds (ETFs). It was a podcast that mentioned World EFT Indices and how these are a form of “investing in the world’s economic growth”. Looking at the historic economic growth of the modern world, this was something I could relate to. I am certain that world economies will continue to grow at least until 2050 by when I will retire (and probably much much longer).

I also learned about the other benefit of ETFs, including their low cost, the possibility to earn dividends (passive income!), and tax benefits.

The decision was made.

My retirement savings will be a diversified World Index ETF, a combination of the MSCI World and the MSCI Emerging Market.

After I had decided that, I was uncertain about when and how to start. The best piece of advice at the time was to break the total investment amount into four equal pieces (each representing 25%) and to invest one piece/quarter every three months for 12 months (4 x 25% = 100%). This approach allows accounting for seasonal or temporary volatility. I did that and was confident with the decision.

Looking back, one thing I would do differently now is that I would not invest in a DAX ETF. I clearly became a victim of the home country bias at the time.

My ETF principles

From the beginning, my ETF strategy was very simple and consisted of four main principles.

- Low risk. Invest in slow-growing low-risk little-fluctuation slow-burner ETFs. Be modest and expect annual growth of 4-6%

- Diversify. Invest in a maximum of 4 ETFs covering global markets

- No trading. No panicking. Keep and hold – I am in for the long shot on a 10+ year investment horizon

- Keep costs low. Total Expense Ratio (TER) at a maximum of 0.30%

How I buy and sell ETFs

I am buying and selling ETFs, using a free online trader account at DEGIRO. I chose DEGIRO as their online trader account is absolutely free and more than 200 ETFs can be bought without any transaction fees. When selling ETFs, Degiro charges €2 + 0.03% which is the lowest I have seen on the market. More about DEGIRO and their free trader account here: https://www.degiro.com

Martin

Nice blog and thanks for sharing. I am curious regarding World Index ETFs – why do you choose USD as currency and not Euro as majority of your investments are in Euro ( p2p ) ?

Peter Kaiser

Hi Martin!

Thanks for your question about USD vs. EUR ETFs. That’s what I love about being transparent about my financial journey. I am learning so much and benefit from the advice – and questions of those that read (and generously comment and ask questions 🙂 ).

So. Your question triggered me doing another round of research on this topic – and trying to understand why I decided to buy the MSCI World USD dominated when I started with ETFs back in 2015. I came to the conclusion that unless the TER is significantly cheaper of an ETF, its best to buy ETFs in your currency. The currency conversion fees are small when buying/selling the ETF, but if they can be avoided at all – let’s avoid them.

So, yes, it would have been slightly better for me to buy them in EUR – and moving forward I will do exactly that 😉

Thanks so much for posting your question! If you are deciding to buy a EUR-nominated MSCI World ETF, please feel free to share its name with us.

Best wishes,

Peter

Sources:

– https://andrewhallam.com/2016/05/expatriate-investors-does-it-matter-which-currency-your-etf-is-listed-in/

– https://www.investorschronicle.co.uk/2017/01/12/your-money/financial-planning/the-cost-of-foreign-currency-denominated-shares-and-etfs-PtRp68lMiRCQAAEsCBtq8L/article.html

Platon

Hi, Peter,

Great job! Thanks for sharing all those details, it is very useful for me.

Have you ever used ETFmatic, I’m interested what is your opinion ? The downside is that you can not choose your own ETFs, but still it dose the job.

Thanks and best regards!

Platon

Peter Kaiser

Hi Platon,

Thanks for your comment. The reason why I am not using ETFmatic or any other Robo advisors is that I want to choose the ETFs myself.

Roboadvisors at times charge additional fees as well. Something that can easily be avoided.

Hope this helps!

Peter

Valygar

I am wondering why did you chose this WORLD ETF (UBS ETF (LU) MSCI World UCITS ETF (USD) A-dis) and not Vanguard or Ishares. They have a much bigger fund size and bit lower TER (0.2%)?

Peter Kaiser

Hi Valygar, thanks for your comment. The reason I purchased the UBS ETF at the time was that my bank had a special offer of 0 fees for the purchase. I do believe that the Vanguard and Ishares are great alternatives, especially given their lower TER I hope this helps!

Best, Peter