Swaper – an honest review

Here is my honest review and experience investing

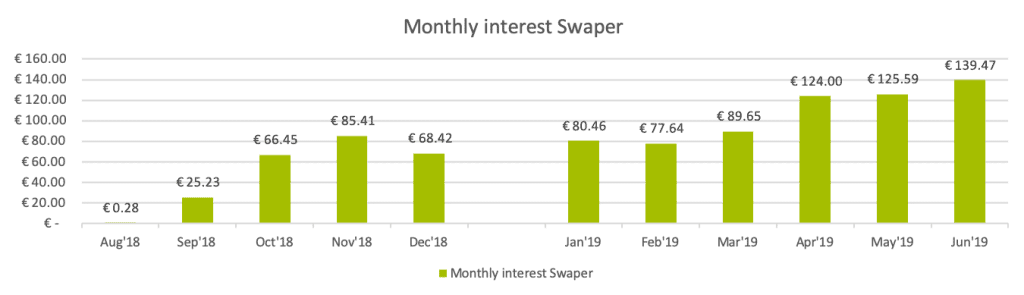

My first investment on Swaper was in August 2018. Before investing, I followed the platform and its development and growth for a while. The sign-up process was easy and straightforward, the deposit registered in my account within 24h.

Monthly interest & interest rates

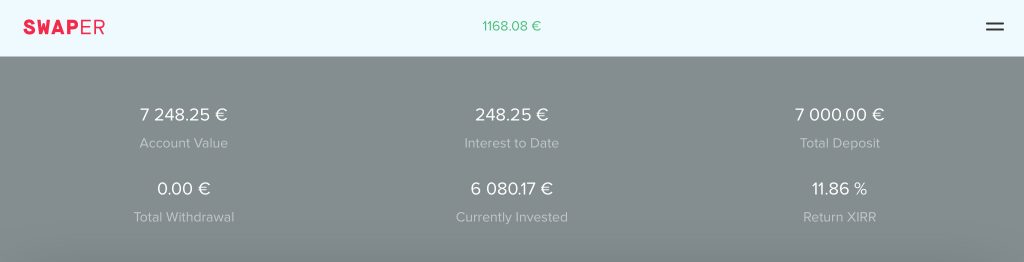

My monthly interest revenue on Swaper is between 65.00 and 80.00 EUR, with an interest of between 11.35% and 14.45% (XIRR). I am very positively surprised by the platform and enjoy using it.

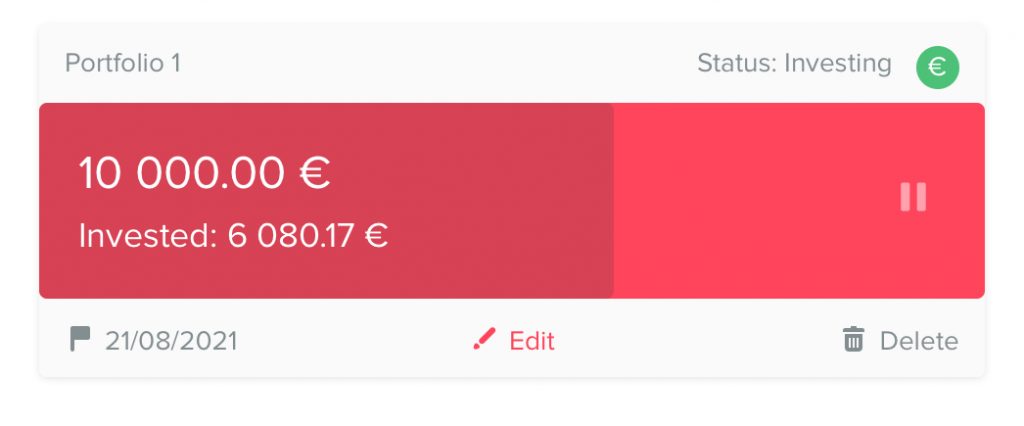

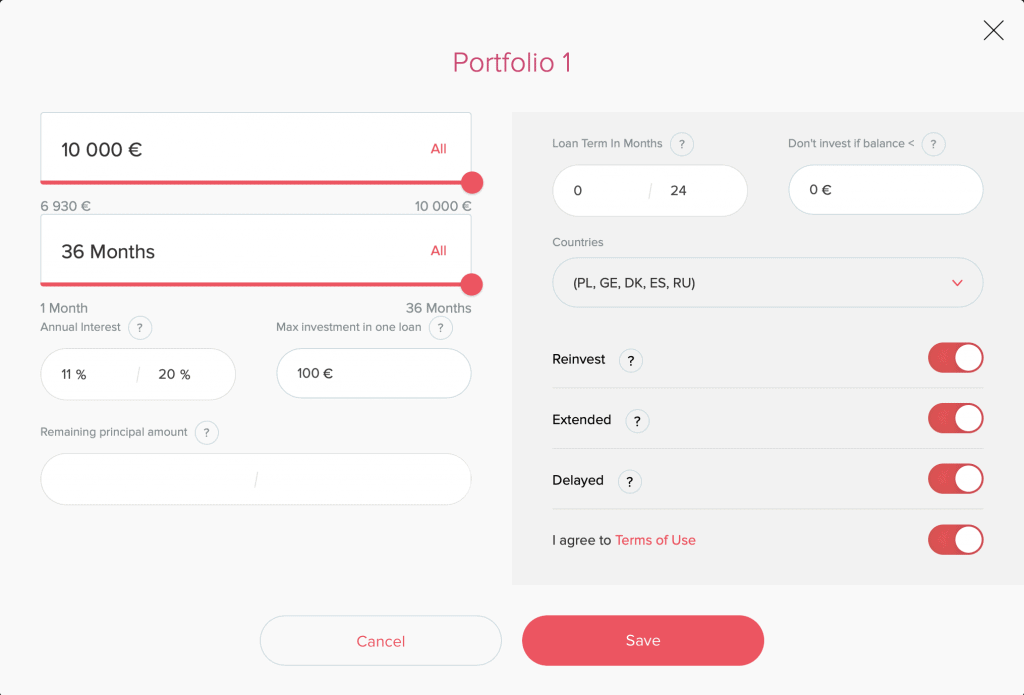

My Swaper auto-invest portfolio

Swaper provides a BuyBack guarantee on all loans that are listed on the platform, which is great! The BuyBack guarantee means that Swaper will compensate investors both for the invested principal and accrued interest in case the borrower is more than 30 days late with short term loan repayment/ 60 days late with long term loan repayment.

Similar to other platforms, my entire Swaper portfolio is automated using the auto-invest functionality. I usually check once a month if things are fine and adjust the auto-investment tool if necessary.