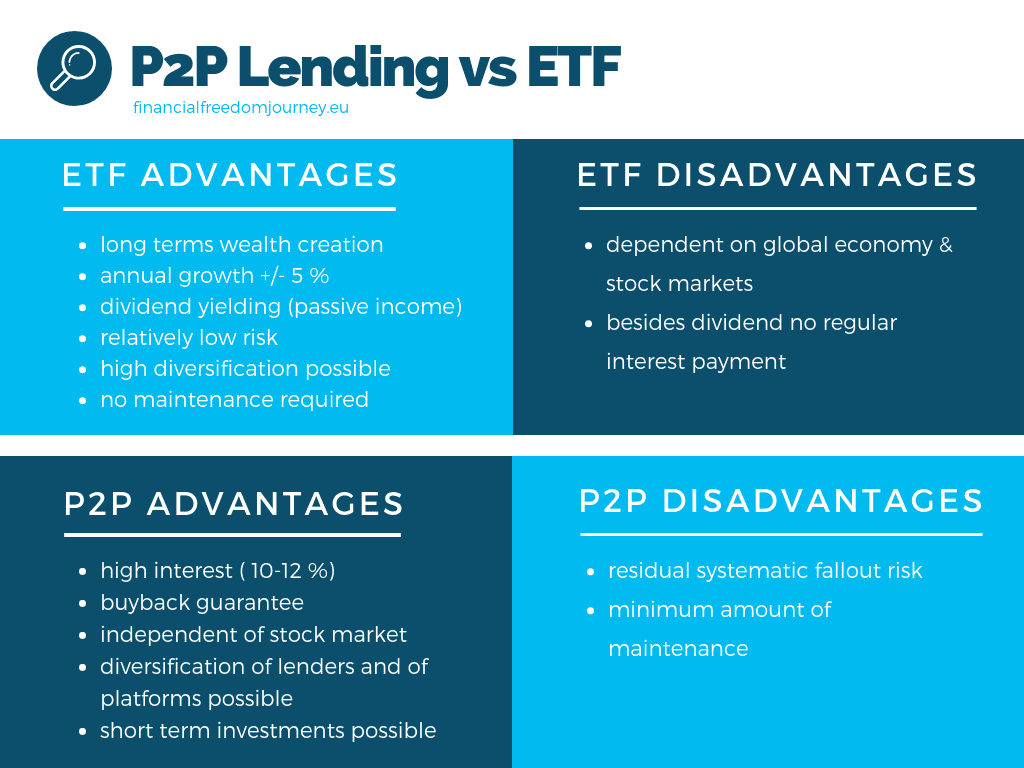

Combining ETFs and P2P loans is an ideal way for me to diversify risk. Due to their different structure and risk profile, ETFs and P2P loans work out as an ideal combination to diversify risk. In addition, ETFs and P2P loans are investments that require almost no oversight: Both run smoothly in the background and harvest interest rates/growth between 5 and 12% per annum.

Harry Markowitz, the Nobel Prize-winning economist, describes diversification as the ‘only free lunch’ when investing.

LET’S LOOK AT THE DETAILS

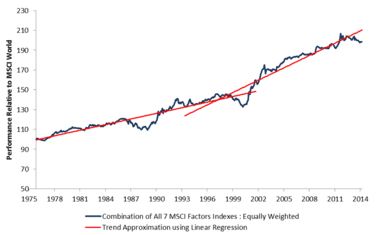

Copyright: MSCI – 40 YEARS OF HISTORY

My ETF portfolio is the backbone of my investment portfolio. The ETF’s I chose in my portfolio represent entire economies and world markets, and thus depend on the growth of the world economy. My ETF portfolio is gaining on average about 5% value per year. In addition, I receive dividend payments every 4 months.

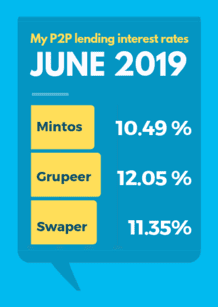

P2P lending complements my investment portfolio and allows me to harvest attractive interest rates at about 10 to 12% per year from P2P loans. Different from ETF’s P2P loans provide monthly payments which creates regular monthly passive income.

While all individual P2P loans in my portfolios are backed by Payment Guarantees through the different platforms, a certain residual risk remains. Especially given the young age of the P2P lending industry (~ it didn’t really take off until 2015), a residual risk of a platform or a loan originator defaulting remains. No doubt, the P2P lending industry carries higher systemic risks than ETFs. However, this risk is being rewarded with the 10-12 % interest rate, which is a good tradeoff.

To minimize the remaining risk, I highly diversify my P2P portfolio to reduce my exposure to certain risks:

> Loan diversification (investing small amounts in many different loans)

> Platform diversification (signing up with more than one P2P platform, e.g. Mintos, Grupeer,

> Loan originator diversification (choosing different loan originators within P2P platforms, e.g. Mintos offers more than 64 loan originators)

> Loan type diversification (choosing different loan types within P2P platforms, e.g. Business loan, Personal loan, Mortgage loan, Agricultural loan, Car loan)

HOW I DIVERSIFY RISK

Investing is never risk-free. This it is important to diversify risk as much as possible and to not place all eggs in one basket.

ETFs and P2P loans have different risk profiles. ETFs are more sensitive to negative shocks and events in the global economy. In the case of a negative event, the effect in stock prices is immediate whereas P2P lending markets are less volatile, more resilient, and thus affected later. This delay of effect in loan markets can give me time to react and to exit the market if there are signs of a bigger global crisis (=s

A global recession, will of course negatively affect both my ETFs and P2P loans, but the impact would not occur simultaneously and hence can be mitigated. For me, a mix of P2P loans and ETFs is the best way to diversify and to reduce the risk characteristics of my portfolio.

If you are interested to read how exactly my investments are distributed across ETFs and P2P loans, look at this

Below is an overview of the advantages and disadvantages of P2P loans and ETFs