My Peer-to-Peer Lending Portfolio (P2P Lending Portfolio)

My Peer-to-Peer Lending Portfolio (P2P Lending Portfolio) includes Mintos,

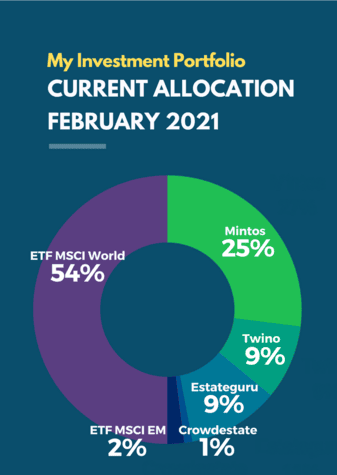

Looking at my total Investment Portfolio, P2P Lending represents 48% which is a significant share. Most investors invest somewhere between 5 and 40% of their total portfolio in P2P lending.

My P2P Lending Portfolio includes three platforms:

- Mintos: The largest P2P Lending Platform in Europe [2020 Review]

- Twino: [2020 Review]

Swaper : [2020 Review]

| Platform | Link | Currently Invested | BuyBack Guarantee | Secondary Market | Invested since |

|---|---|---|---|---|---|

| Mintos Review | € 32,100.00 | Yes | Yes | Jun'2016 | |

| Twino Review | € 13,500.00 | Yes | No | Jun'2016 | |

| Swaper Review | € 0 | Yes | Yes | Aug'2018 |

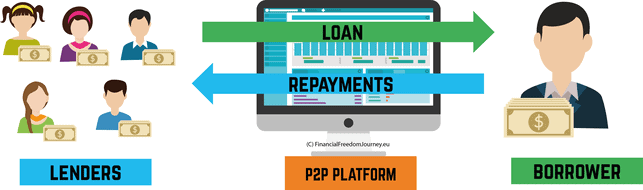

What is Peer-to-Peer Lending (P2P Lending):

P2P lending is lending from individuals to individuals (peers to peers), cutting out the financial institution as the middleman. P2P lending is also known as social lending or crowdlending. Enabled by technology and the Internet, P2P Lending has first become popular in 2015 and has since grown enormously. (Source)

Is P2P Lending risky?

No doubt, P2P lending bears certain risks just as every other form of investing does. Fortunately, there are different ways to protect oneself from most of the risk, such as by only investing in loans with BuyBack Guarantee, or by diversifying between platforms. More about in below

Ways to reduce risks when investing in P2P loans

- Split money among platforms

In my opinion, this is the most important aspect and best way to reduce risk. By not putting all eggs in one basket and using multiple platforms, one can significantly diversify and reduce risk. If one platform underperforms or runs into some issues, one has alternatives. Personally, I find for myself that investing in 3 platforms works best for me as it keeps the ‘oversight’ manageable. When investing in too many platforms, it’s easy to lose track and make silly mistakes (e.g. accidentally investing in loans without BuyBack guarantee)

- Split money among loan originators

This is the second most important point. Most P2P lending platforms offer loans from multiple loan originators (Mintos: 64 loan originators). Strictly following a strategy of maximum diversification, hence investing in as many loan originators as possible, reduces risk significantly. If one loan originator becomes delays payments or becomes insolvent, the damage is not too bad.

- Choose the loan originators wisely (BuyBack guarantee)

As mentioned before, be careful when investing and make sure you have ticked the box BuyBack guarantee. Interest rates for loans without BuyBack guarantee are usually 1-3% higher…but one has no protection as an investor. It is not uncommon that loans are delayed or default. In these cases, with BuyBack, the loan originator covers the damage. - Don’t become greedy

Another very important point, It is very easy to become greedy when investing in P2P loans. Very often loans with interest rates above 12-13% are only a click away and its easy to fall for them. Don’t become greedy. Remember yourself that even 10, 11, 12 percent interest are already beyond what one could dream of.

My 6 key P2P Lending principals:

I am following 6 simple and straightforward principles for all my P2P loan investments:

- Everything is automated through auto-investment portfolios

P2P Lending is a source of passive income for me. All platforms that I am investing in offer auto-invest portfolios which 100% automate the process of investing. Once set up, there’s nothing left to do and I can watch interest and principal payments arriving and being reinvested as per my auto-invest settings. My auto-invest settings for each platform can be found here: Mintos,Swaper , EstateGuru, CrowdEstate.

With everything set up, I am logging into my accounts once a month, to make sure everything is going well and my money is being reinvested. - I only invest in secured P2P loans with BuyBack guarantee

Another important principle for me is that I only invest in P2P loans that are secured with BuyBack guarantee by the loan originator. Most platforms offer both secured and unsecured loans with slightly higher interest rates, but I am not willing to take that risk and thus only invest in loans with BuyBack guarantee. - No investments in small or uncredible platforms

Being a small investor with limited capital (my retirement savings!), I am not investing in small or uncredible P2P lending platforms. As the P2P lending industry continues to grow, new platforms are popping up like mushrooms. It would be easy to be sucked into the gold rush and invest in whichever platform pays the highest interest rates. Being a private passive income investor, my principle is to only invest in platforms that have been around for at least 3 years and have a certain size. I am limiting myself to 5 large platforms to reach a decent level of diversification (in case one platform underperforms) while keeping things ‘passive’ and manageable. A good resource that I am using to check the size and age of a platform is P2P Market Data, which features data from more than 100 platforms. - Only investments in P2P loans in the EUR currency

To avoid currency fluctuations, which in this day and age of trade wars are only getting worse and more unpredictable, I am only investing in loans in the EUR currency. - Annual Interest rates >10%

Considering that a certain residual risk remains when investing in P2P loans, I am only investing in loans/platforms that offer at least 10% interest in return. This might sound counterintuitive and one might ask whether platforms and loans with lower interest rates are more secure. To some extent, yes, but there is always a risk of platforms going insolvent. With an annual return of 10+ %, I am buying myself some space (even if 10% of the loan originators would flip each year, I would still be making money). Does that make sense? - Invest in long-term loans

The P2P Lending market is booming and interest rates are expected to drop over the coming months. While more and more investors are investing in P2P loans, the supply of loans (individuals lending money) is only growing slowly. As investors are competing for loans, interest rates are dropping (supply and demand). To counter declining interest rates, I am investing in long-term loans that allow me to “lock in”high interest rates for as long as possible. For example, if I am investing in a 48-month loan at 12.5%, I am guaranteed 12.5% for the next four years. If I want to leave the market early, I can easily sell the investment on the Secondary market.

Thanks for reading! Before heading out, would you be interested in reading my experience investing in Mintos, and Twino?