Welcome to my July 2020 Passive Income Update.

This past month went by quickly. Too quickly. As a person who believes in actively and intentionally creating memories (e.g. by traveling, learning something new, exploring new places), the COVID-19 lockdown is tough.

Many of my days in June looked and felt alike. A certain routine has crept into my life. Work, Exercise, Time with family. Sleep. Repeat.

Over the past weeks, I have tried to explore at least one new place per week. Either for a run, for a hike, or just to see something different. It helped!

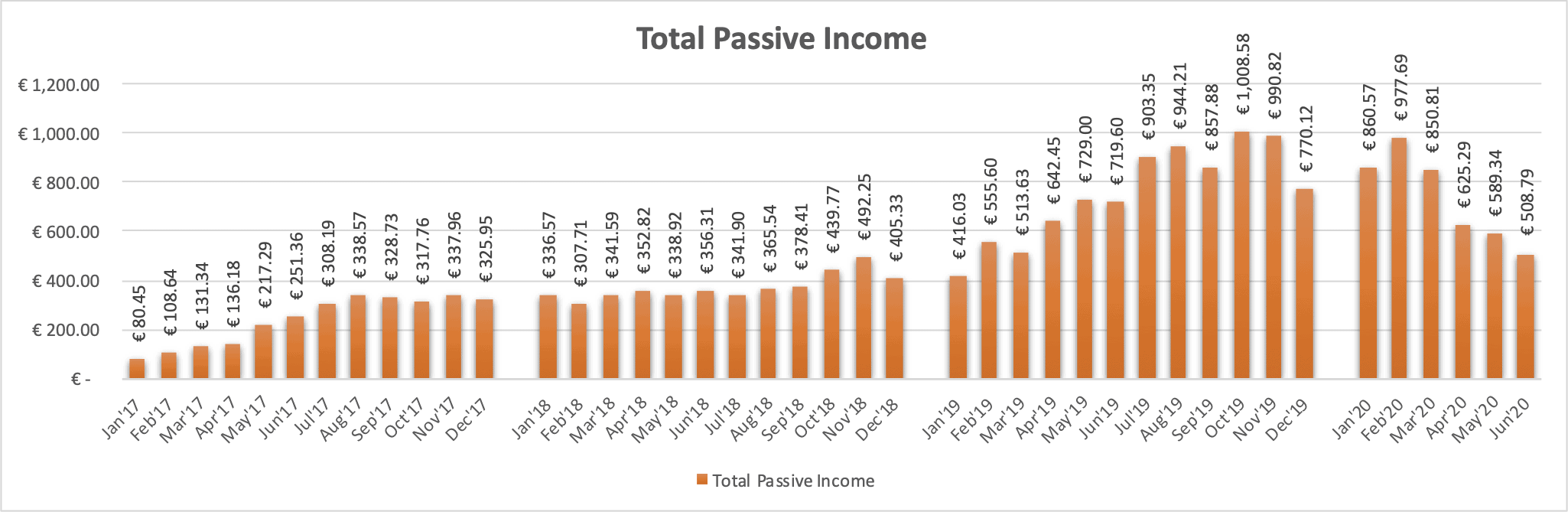

My passive income update: The pandemic has made many investors more careful – including myself. I shifted my investments to larger platforms, started accepting lower interest rates in exchange for lower risk. I also rather have some balance uninvested in my accounts than investing in projects and loans that I don’t feel 100% comfortable with. The result: Lower monthly returns. While I earned 900+ EUR/monthly at the end of 2019, my monthly returns are now down to around 500+ EUR. But that’s fine, and I expect them to go back up once the pandemic is over!

Overview: My total passive income in June 2020:

– P2P lending: 390.70 EUR

– Real Estate Lending: 21.15 EUR

– ETF Dividends: 64.56 EUR

– Stock Photos/Videos: 32.38 EUR

TOTAL: 508.79 EUR (~571.35 USD)

P2P Lending & Real Estate Lending Update – July 2020

P2P & Real Estate Lending Overview – July 2020 Passive Income Update

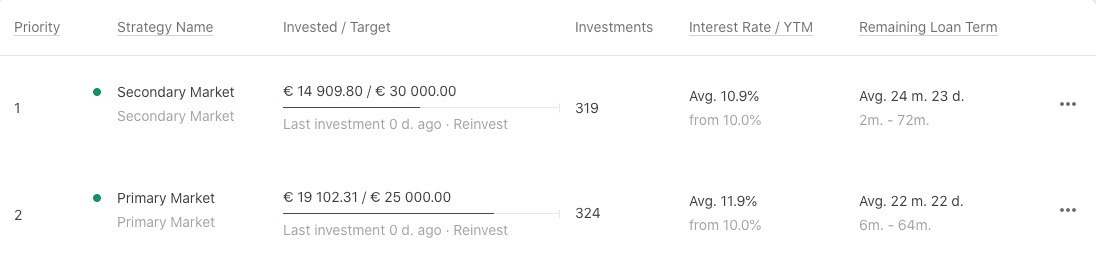

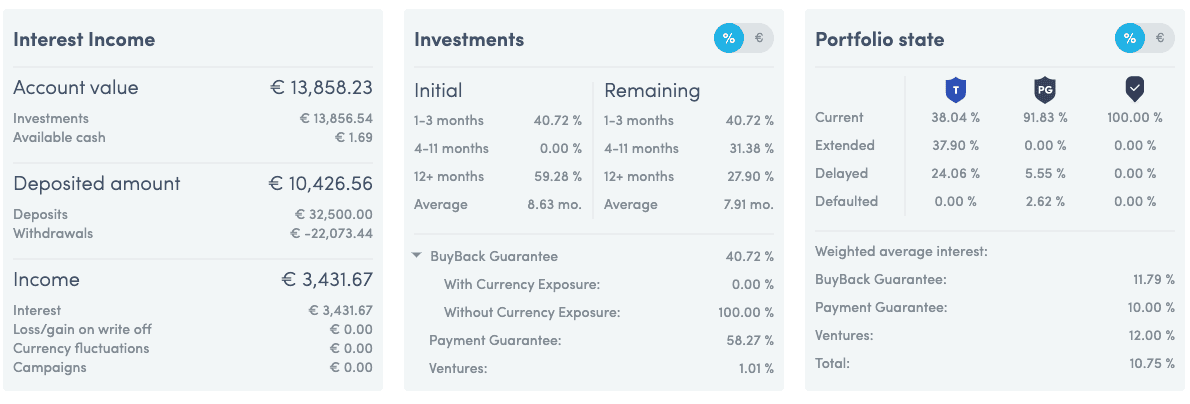

As part of my July 2020 passive income update, here is a quick overview of passive income that I was earning this past month from three (3) P2P Lending and two (2) Real-Estate P2P Lending platforms that I am currently investing in.

Given the recent scandals around smaller and newer P2P Platforms (see Grupeer below), I decided that – moving forward – I will only invest in/on larger platforms that have been around for many years. Mintos was founded in 2014 and has since funded € 5.3 billion (€ 5,341 million) worth of loans. Twino celebrated its 5-year birthday this year with more than 20,000 investors who helped to fund nearly € 700 million through the platform. Swaper was launched in 2016 and has since funded € 168 million in loans.

Exchange– Traded Funds (ETF) Update – July 2020 🥳

Even in times of unstable (stock) markets, I hold onto my opinion that starting investing in the MSCI World ETF back in 2016 was one of the best decisions of my life. I am explaining details in my ETF portfolio post, but in a nutshell, I believe there is no better and more cost-effective way to save & invest long term (e.g. for retirement) while earning passive income from dividends.

Why would I say that? Since I started investing in the MSCI World ETF in 2016, the value of the ETF has increased by 42.56% (despite the recent coronavirus-related shock in stock markets). The shares that I bought originally for 145.09 EUR a piece are currently valued 199.72 EUR.

Coronavirus and my ETF portfolio

The spread of COVID-19 is affecting economies and most of the 1600+ companies that are part of the MSCI World ETF are affected just as much. The MSCI World ETF that I have invested in had temporarily dropped in value from 224 EUR to 164 EUR per ETF share, but is now already back up at 199 EUR.

I am not worried and I feel certain that the MSCI World ETF will continue to grow in value over the coming years. In fact, I wish I would have bought more ETF shares when their value was at 164 EUR 🤪.

My 1,000 EUR monthly ETF savings plan

Many of you will know about my 1,000 EUR monthly ETF savings plan which I talked about in my January Blog Post. It’s automated, runs in the background, and keeps buying MSCI World ETFs worth 1,000 EUR on the first of every month. It’s a fantastic way of cost-averaging and keeps me committed to my financial savings goals. More about my ETF savings plan and why it was such a great idea to go back to an automated saving plan in this blog post.

That’s it for my July 2020 Passive Income Update! If you are interested, please follow my journey on my Facebook page Financial Freedom Journey for more frequent updates. And as always: If you have any questions or comments, please pop them in the comment section below. Or get in touch via Facebook or Email.

Stay safe, stay healthy, and please do practice social distancing and save lives!

Peter 👋