Jan’19 | Reflections

As 2018 has shown, stock markets are not just always going up. Ups and downs are the rule, and one should expect fluctuations.

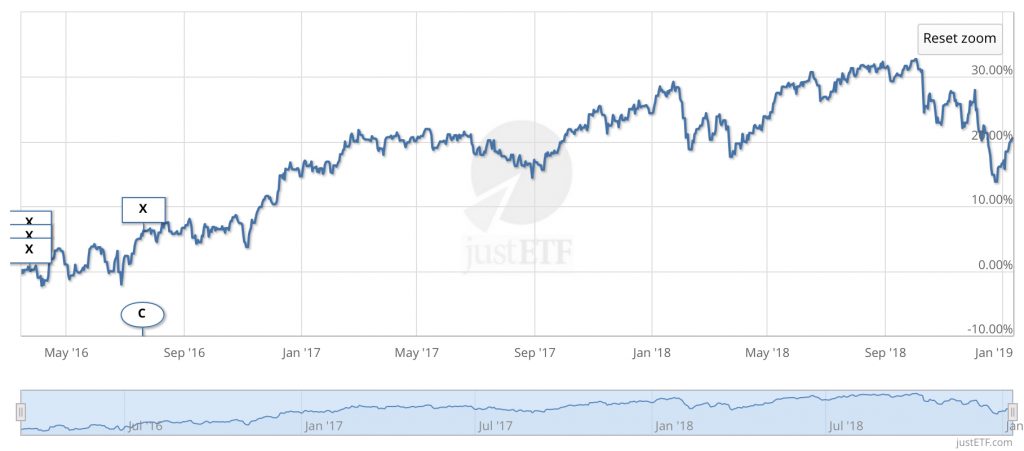

This being said, since the financial crisis in 2008, stock markets only knew one direction: Upwards. Since I first invested in ETFs three years ago, in October last year my portfolio had grown by 32.55%. 🤩

But this trend is over for now. 2018 was a bad year for global stock markets and thus for ETF investors. The DAX dropped by over 18 percent and the Dow Jones by 5.95 percent. 🥶

The current drop in the value of my ETF portfolio is daunting. Shall I sell my ETFs and invest elsewhere? P2P loans would be an attractive alternative for me.

I decided not to. Why? Rather than panicking about low prices, I reminded myself to act counter-cyclically (as one should when investing in ETFs). Now is the best time to double down and buy more ETFs. Prices are down and the MSCI World ETF can be bought at 2016 prices.

One lesson I have learnt this past year is to diversify and to spread my investments globally. While my DAX ETF dropped by 12 percent since Jan 2018, my MSCI World Index only dropped by 1.17 percent. Lesson learnt! 💡

Given that I consider my ETF investments as a long-term wealth creation tool, I am not too worried about the bad performance in 2018. Looking at the 5-year value development of the ETFs I am holding, I am confident that the performance of the past years is a good indication of the long-term future performance.

Therefore, it doesn’t matter much if ETF prices are going up or down short-term. As long as they are going back up.The past performance of my ETF portfolio should be a good indication of its future performance.