Welcome. This is a blog documenting my journey to financial freedom through passive income.

Born in 1988, I would describe myself as a millennial with typical millennial aspirations. I am passionate about life, I love traveling, and I love spending time outdoors. ✈️🌴🚵♂️☀️🏄♂️⛱️🕶️

WHAT IS THIS BLOG ABOUT?

My goal is to document my journey and to show to others how even small savings – invested the right way – can lead to a considerable monthly passive income.

I started with 25 EUR in monthly passive income less than three years ago. Today my monthly passive income covers 60%+ of my monthly living expenses (900 EUR of 1500 EUR).

Not having to worry about money allows me to take extended breaks from work (2-3 months at a time), to live life, and to travel the world.

HOW IS THIS BLOG STRUCTURED?

I am trying to keep things concise and to the point. So, let’s get right into it. This blog provides the following:

- Monthly Summary Updates

- P2P Lending Platform Reviews:

- P2P Real Estate Lending Platform Reviews

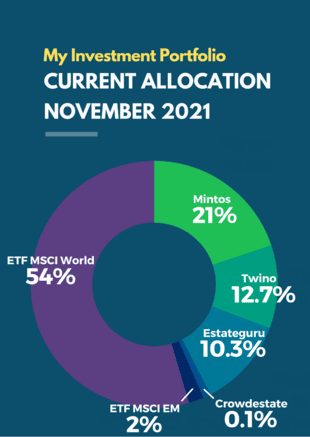

- My Investment Portfolio:

HOW DID I START?

In early 2016, inspired by a number of podcasts (Smart Passive Income, Finanzrocker Podcast) and blogs, I started converting some of my savings into ETFs. My first investment was 500 EUR. And things went well, and so I continued investing in the same 2 ETFs until today.

In late 2016, I started investing in Peer-2-Peer (P2P) lending. My first investments in Mintos and Twino were 500 EUR per platform. Similar to my ETF investments, things went well and my P2P portfolio grew, providing monthly interest payments. As of Nov 2019, my P2P portfolio has grown to 63,000 EUR, providing monthly interest payments of 600+ EUR.

From Day 1, it was important for me to be cautious and careful. I am extremely risk-averse. I am not a trader or financial expert, nor a person that spends hours following the stock – I am the opposite of that. Rather do I spend time outside than in front of my computer. To manage my investment portfolio, I invest around 2 hours per month. With this in mind, please be aware that this blog is not providing any legal or financial advice.