Traveling the world while working remotely as a digital nomad and earning passive income is a dream that I have been living for the past 4 years. It’s been an incredibly rewarding experience and I can’t imagine going back to a 9-to-5 job. Ever.

Moving through the world and waking up in a new place every few weeks is incredible. The more I travel the more I realize that there is just so much to see, to do, and to discover out there. ✈️

Rather than spending 8 hours a day in front of my computer, I am working on average somewhere between 4 and 6 hours a day while on the road. I have learned about myself that it is not only incredibly difficult to work 40-hour weeks while traveling as a digital nomad, but I also much rather explore the place I am in and meet new people than lock myself up in my

Many of my friends ask me how I can afford my digital nomad lifestyle, without working full time.

The answer is by earning passive income online.

How earning passive income works for digital nomads

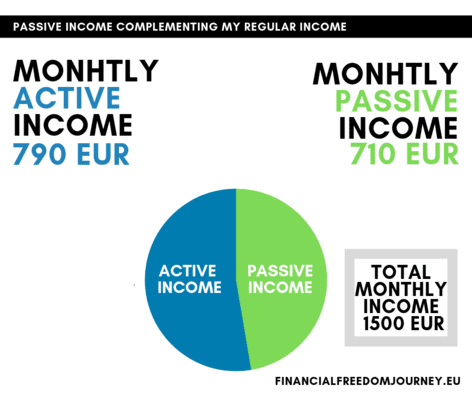

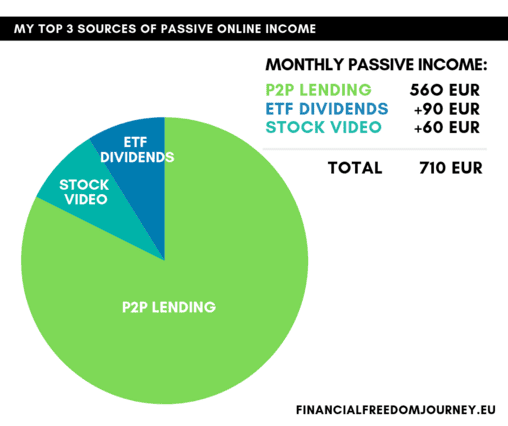

This month, I am earning a bit more than 710 Euro (= 750 USD) in passive income. The 710 EUR nicely complement my income from my regular work as a digital nomad and give me the freedom to work less, to feel less pressure finding remote work, and allow me to live and to travel more.

Passive income means that I am earning money through automated “ventures” which require minimal time and effort. Whether I work or take a day off, my passive earnings remain the same. I am also earning money while sleeping.

When I first heard the idea of building passive income a few years ago, I was super skeptical. Afraid of being sucked into some weird pyramid schemes or dodgy cryptocurrency trading scam, I refused to believe that building passive income is something everyone can do and that it is actually pretty easy.

Since then, I have not only read, seen, and

If you are a digital nomad or aspire to become one, read on to learn what types of passive income might work for you, what to pay attention to, and how to get started.

Table of Content

- What is passive income?

- How much money can I make as a digital nomad?

- Difference between Active and Passive income

- The top 3 ways to create online passive income as a digital nomad

- P2P Lending – (How to start)

- Exchange-Traded Funds (ETFs) & Dividends – (How to start)

- Stock Photos and Videos – (How to start)

What is passive income?

Passive income is money that you earn in a way that requires little to no daily effort. Some passive income sources—like renting out property or building a blog—may take some initial work to set up, but they eventually earn you money while you sleep. (Source)

Examples of passive income sources are:

- Starting a blog or YouTube channel

- Selling digital products (eBooks, online course, Amazon FBA)

- Investing in ETFs and P2P Lending

- Buying an apartment and renting it out to tenants

- Selling stock photos and videos

As a digital nomad, not all mentioned examples of passive income work with my digital nomad traveling lifestyle. Some passive income sources are more time consuming than others (i.e. setting up and running an Amazon online store is essentially a full-time job) and some require large amounts of capital and investment expertise (buying a property and renting it out) – neither of the two I have as a digital nomad.

However, certain forms of passive income are working even better for me as a digital nomad than they work for someone who is traveling less. See below section on Stock photos/videos for example.

When deciding which source of passive income to pursue, it was important to me that the time it takes to set everything up and manage is less than a few hours per month.

How much money can I make as a digital nomad?

Don’t expect that passive income will make you wealthy overnight or that you never have to work again. Forget about any get-rich-quick or pyramid schemes you’ve heard of. Rather, passive income is a steady, profitable passive income source that runs in the background and can complement your regular income. We’re talking about a few hundred Euros every month —depending on the number of passive income streams.

More important than how much money you can make is that every Euro provides you with freedom from everyday work. Every Euro earnt in passive income is a Euro that you don’t have to earn in your ‘regular’ job.

What is the difference between Active and Passive income? (Active income examples and passive income examples)

If you are still unclear about the difference between active and passive income, this will clarify:

Active income is income from everyday activities. For example your full- or part-time job. If you stop working, you won’t get paid. In many cases your salary depends on the number of hours you have worked. If you work less, you earn less. If you work more, you earn more, but you have less free time. Further, you rely on your boss, your colleagues, or others who can influence how much you earn.

Owning your own business is also a way of active income. While your own business doesn’t force you to spend every day in the office, it still demands continuous efforts to be managed.

Passive income is income resulting from cash flow received on a regular basis, from an activity in which you are not actively involved and that requires minimal to no effort to be maintained. For example, passive income can come from royalties, dividends from investments, affiliate marketing, interest on investments, blogs, websites

Passive income often requires an initial effort to be set up. Once set up, it provides stable income whether you work or not. Some forms of passive income require nothing but an internet connection and a few hours of time to be set up.

Why online passive income works great for digital nomads

One of the reasons why passive income works so great for digital nomads is that it is not time-sensitive. It suits your schedule as a digital nomad as you can work on it whenever you have time. There are no set working hours. For example, one can work hard for a week and set everything up and then keep earning passive income years.

Another reason why they work great for digital nomads is that passive income streams are location independent. All forms of passive income which I describe below, can be set up and managed from anywhere in the world. You could be on the beach, in a coffee shop, on a bus, or at an airport gate and work on your passive income streams.

The top 3 ways to create online passive income as a digital nomad

I experimented with different passive income approaches over the past 4 years. Here are my top 3 ways to create online passive income as a digital nomad – based on my own experience. All described forms of passive income are (a) creating a monthly passive income stream, (b) easy to set up, and (c) require only a minimum amount of monitoring/maintenance:

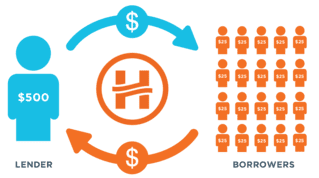

Peer-to-Peer (P2P) Lending

Peer-to-Peer Lending (P2P lending) is the practice of lending money to individuals or businesses through registered online services (marketplaces) that match lenders with borrowers. P2P lending is an alternative to traditional institutional lending (=banks) and is a great way for digital nomads to invest small amounts (as little at 500 EUR) in return for solid interest rates (12-14% p.a.). Interest is paid monthly and thus an ideal passive income stream for digital nomads. If one needs to access their funds, loans can be sold at any time on the secondary market, which usually takes less than 24 hours. Mintos is a popular P2P lending platform. More below.

As an example:

- If you invest 1000 EUR at the current 12-14% interest rates, you receive between 120 and 140 EUR interest per year.

- If you invest 10000 EUR, you receive between 1200 and 1400 EUR interest per year. That is more than 100 EUR in interest per month.

Pros of P2P lending:

✅ Monthly passive income payments

✅ High interest rates (12-14% per year)

✅ Location independent: Everything happens online (registration, interest payments, etc)

✅ Funds almost immediately available if need be

✅ BuyBack guarantee gives safety that loans will be paid back

✅ Extremely flexible & very little setup time

Cons of P2P lending:

🔶 Requires certain amount of savings to start (500+ EUR)

History of Peer-to-Peer (P2P) Lending in Europe

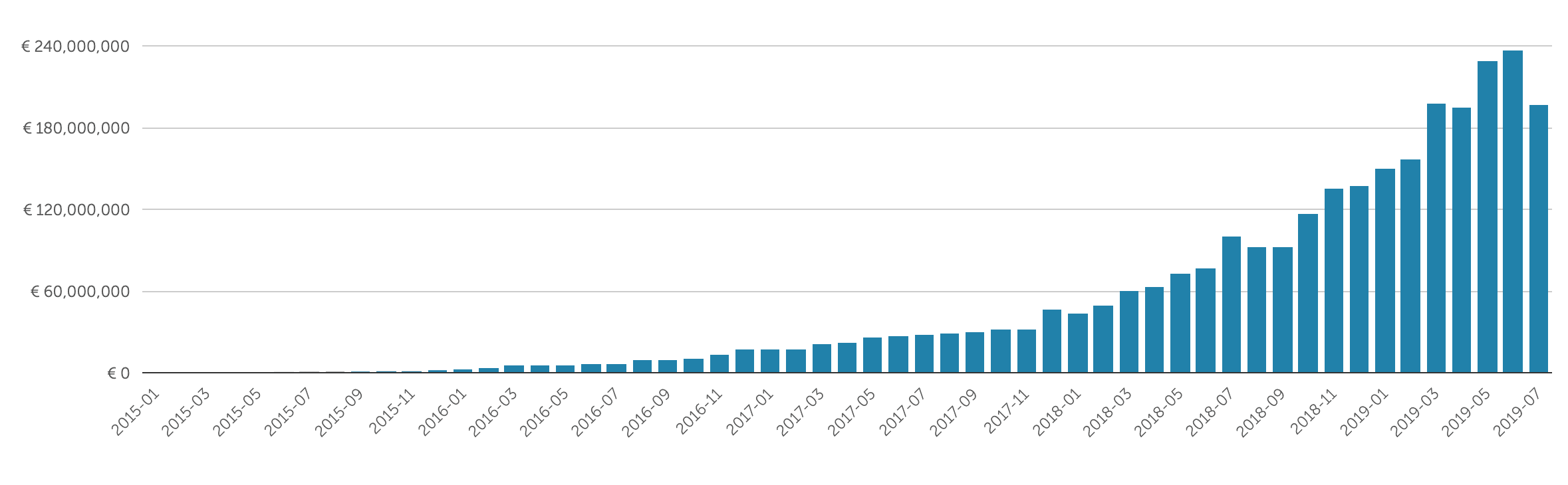

If you are wondering why you have never heard of P2P lending: The European P2P lending market didn’t really exist until a few years ago. Mostly due to banking regulations, the wide availability of consumer credits pre-subprime mortgage crisis, as well as the absence of technology that enabled platforms to automate advanced loan screening and the distribution of individual loans among hundreds of investors.

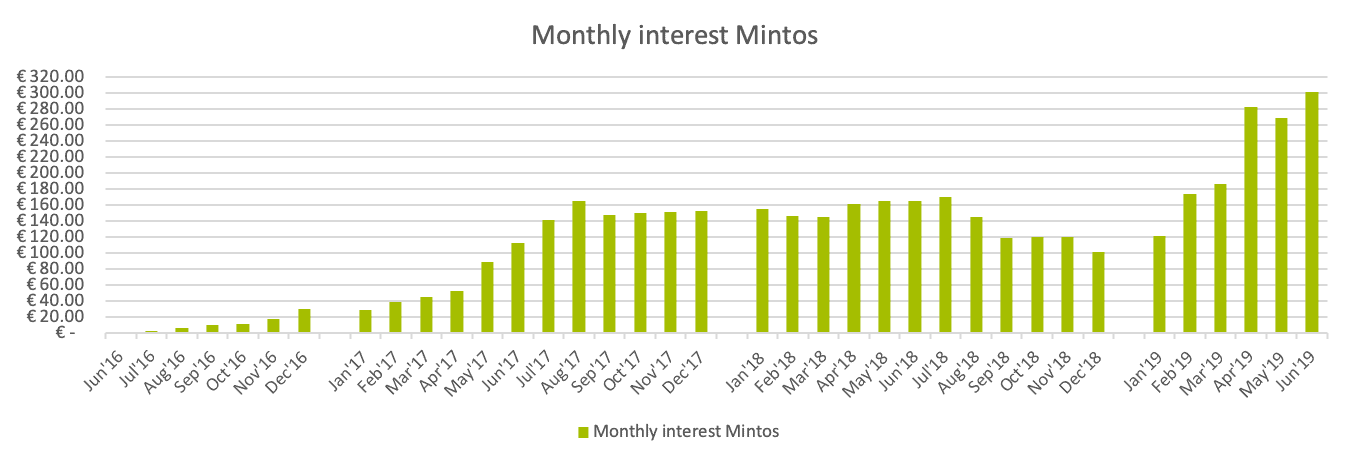

I started investing in P2P loans in 2015 and have made nothing but good experiences. Most of my FinancialFreedomJourney.eu blog is about P2P lending platforms and includes all

How to start with P2P lending?

There’s a large number of P2P lending platforms out there, but I recommend to start with the biggest P2P lending platform Mintos. Due to the large size of the platform, Mintos allows to automatically diversify your investment across 60+ loan originators. Once your auto-invest platform is set up, you can lean back and watch your daily interest payments trickle in. Here’s a tutorial on how to get started and how to set everything up.

Exchange-Traded Funds (ETFs) & Dividends

Exchange-traded funds (ETFs) are something of a cross between an index mutual fund and a stock. They trade like individual stocks and can be bought and sold through a stock trading account with an online broker. I am using ING Bank’s free trading account.

ETFs have surged in popularity over recent years as they offer investors a simple way to build a diversified portfolio on the cheap.

If you have never heard of ETFs, here are some important cornerstones:

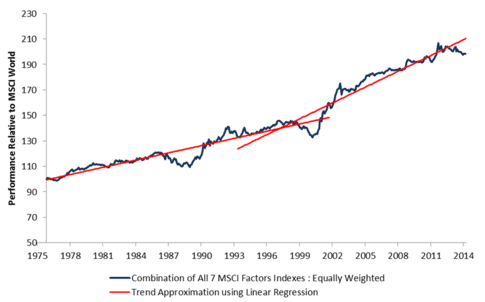

- ETFs represent indexes — indexes such as the Dow Jones, the DAX, or indexes representing entire markets, entire industries, regions, or countries. For example a Dax ETF, is an index that represents the German DAX, hence the German economy. If the German economy thrives, the DAX goes up, and so the DAX ETF goes up. If the German economy recedes, down, the DAX ETF goes down. In a similar way, a popular the MSCI World ETF represents the global economy by looking at the performance of 1600 companies, representative of the global economy.

- ETFs are bought and sold just like stocks (through an online broker), and their price changes from second to second. ETFs can be bought and sold within minutes.

- Although ETF’s require a small trading and a small management fee, they cost much less than a mutual fund or shares (around 0.30% versus 2-3 %). Brokers don’t like to talk about ETFs as they don’t get any bonus buying them for their clients.

- Certain ETFs pay regular dividends. That means that either quarterly or annually, the holder of the ETF receives a dividend. These dividend payments can serve as passive income. Depending on the ETF, dividends can be up to 6% per year.

Pros of ETFs:

✅ ‘safe’ long-term investment

✅ Quarterly passive income payments through dividends

✅ Location independent:Everything happens online (registration, purchase of ETFs, etc)

✅ ETFs can be sold at any time. Funds immediately available.

✅ Absolutely no maintenance required.

Cons of ETFs:

🔶 Requires a certain amount of savings to start (100+ EUR)

🔶 The average return of my ETF portfolio is 5%, which is less than my P2P lending portfolio (12%).

How to start with ETFs?

If you are interested in learning more about ETFs or building your own ETF portfolio, have a look at my ETF portfolio and read this tutorial. Buying an ETF is incredibly easy and a good long-term investment for digital nomads.

Stock photos/videos

Another great form of passive income is the selling of stock photos and stock videos online. If you are unfamiliar with the terms stock photos and stock videos, here is an explanation:

Stock photos are photos that photographers have already shot and made available for purchase/licensing to anyone who is interested by paying a licensing fee. Stock photos are widely used in all kinds of commercial, editorial, and entertainment content and advertising.

Media agencies, bloggers, newspapers, and many other often use stock photos in their media. It’s much cheaper for them to buy a stock photo rather than hire a photographer. In addition, the stock photos are already created and available for use without any delay. That’s why stock photos and videos are such a great resource for anyone needing images for professional use. Their immediate availability and low cost solve both time and budget issues at once.

How to sell stock photos and videos?

There’s a number of stock websites which allow anyone to sell their photos and videos through their platform. These so-called stock platforms take a cut from each sale but host images at no cost to you. Popular platforms include Shutterstock, Fotolia, iStockphoto, Pond5, and Adobe Stock. My favorite platform is Shutterstock.

Stock videos: Stock videos are 10-60 sec video clips. Clips have to be unedited and in high resolution (1080p or 4K). One clip is usually one scene, for example, a 60-sec video of a busy traffic intersection, a slow pan of a cityscape during sunset, or a person eating ice cream in Italy. Or a photo of a digital nomad working on the beach. When shooting stock video, think about what clips a media agency, a blogger, a video editor, or a YouTuber could be looking for.

How much can I earn with Stock photos and videos?

In general, stock photos and videos earn somewhere between 25 to 45 cents per image or video, per month. This obviously depends on many factors, including how many platforms you upload to, your skill in key-wording, and the uniqueness of the images/videos footage.

Most stock platforms offer a tiered commission rate. Shutterstock, for example, pays an initial 25 cents per download, with a tiered set of raises to 33 cents, 36 cents and 38 cents per download as you reach the $500, $3,000 and $

Some

I am currently earning between 80 and 150 EUR per month from stock sales. I only do stock video and I have uploaded about 200 clips to date.

Stock photo and video as a digital nomad

As a digital nomad, through your travels, you encounter lots of places and motives that can be sold on stock websites. Open your eyes while traveling and think about what photos/videos others might be looking for.

You don’t have to be the best photographer under the sun to be able to shoot good stock photos. You will see that many photographers shoot somewhat mediocre photos and have more than 1,000 images featured on stock websites. It’s about shooting relevant photos and detailed keywording.

Pros of Stock photos/videos:

✅ It’s 100% free! All platforms are free to join and photos and videos can be uploaded for free. You can never lose any money!

✅ After the initial uploading of stock footage, everything else is automated. You will earn passive income from photos and videos that you have uploaded years ago.

✅ Location independent: Everything happens online (registration, interest payments, etc)

Cons of Stock photos/videos:

🔶 Exporting, key-wording, and uploading of photos and videos can be time consuming.

🔶 Purchase of camera/drone required (maybe you already have one?)

How to start with Stock photo and video?

Getting started is really easy. After you have signed up with one of the stock platforms (e.g. Shutterstock), you can upload your first batch of photos of videos. Once uploaded, you have to keyword them which includes adding a title, location, and keywords that people might search for. As a final step, the respective platform will review your photos/videos and approve those of sufficient quality. Blurry, dark, or photos of insufficient quality will be rejected.

And that’s it. Once uploaded and approved, all you have to do is to wait until someone buys one of your photos or videos.

Conclusion: Start today and support your digital nomad lifestyle through passive income.

As you can see, with little effort to set things up initially, you can be set free from either your 9-5 day job or from the stressful need to find digital nomad remote assignments to cover all your living expenses.

With passive income, you can earn money without having to spend hours behind your computer every day while you are traveling around the globe. Doesn’t that sound enticing? It’s all possible and all numbers and facts stated in this article are 100% honest.

I encourage you to start today and to celebrate once you have made the first few Euros in

Thanks for reading. Please let me know if you have any questions or comments about passive income as a digital nomad. Share your thoughts and your progress in the comment section.